DBS Visa Debit Card - Your Multi-Currency Card

every day, everywhere.

Up to 5% cashback* on any foreign currency spending with your DBS Visa Debit Card – even online!

Here’s how:

Period | Cashback | Valid for: |

|---|---|---|

National Day 9 to 11 Aug 2024 | Up to 5% cashback Capped at S$40 per period. | All foreign currencies spend |

School Holidays 31 Aug to 8 Sep 2024 | ||

Year End

| ||

Malaysia Weekend Exclusive 17 Aug to 29 Dec 2024 | Up to 5% cashback every Sat & Sun Capped at S$10 per week | Malaysia Ringgit (MYR) spend |

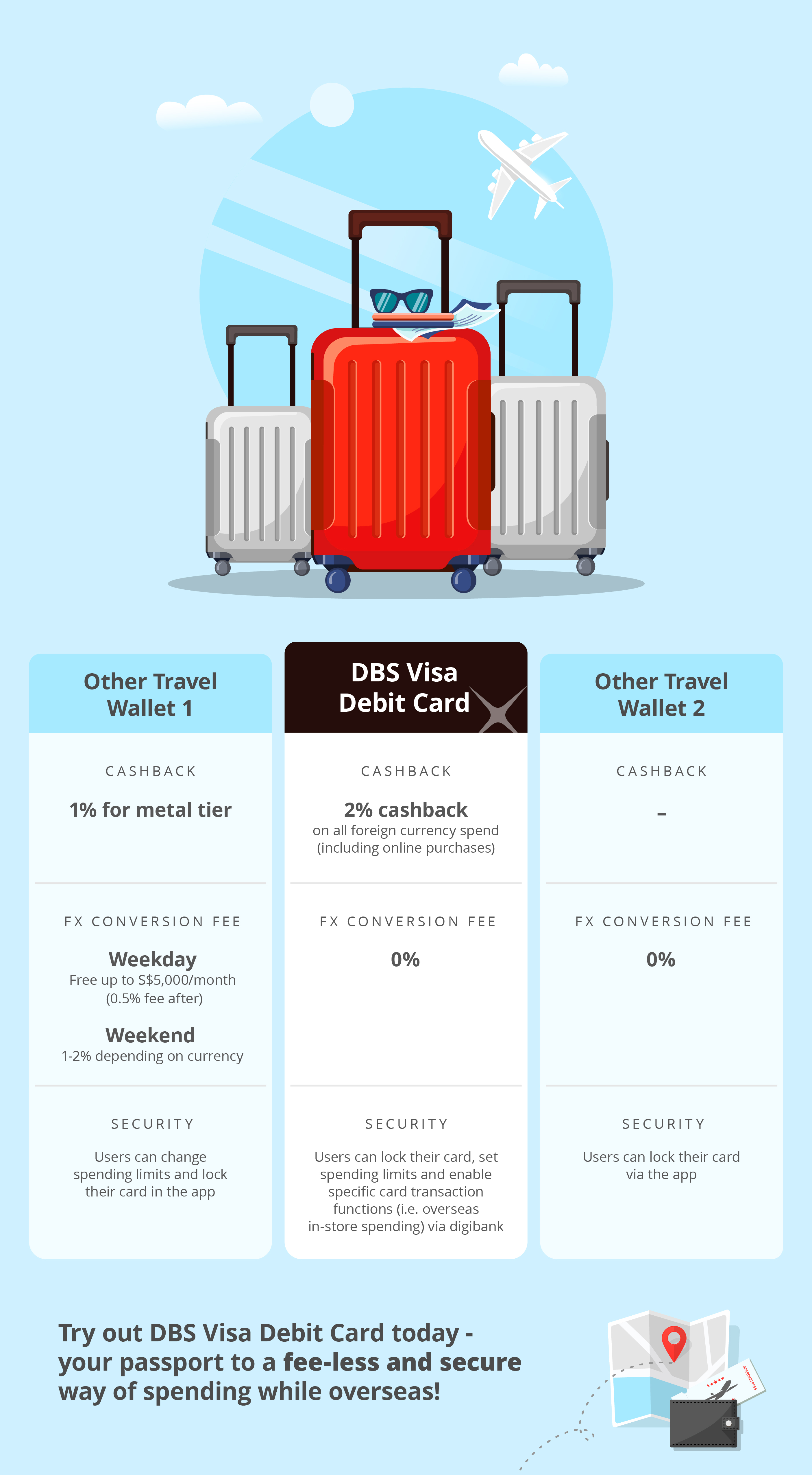

All other periods | 2% cashback | All foreign currencies spend |

*Valid with a minimum of S$500 on Visa and cash withdrawals limit of S$400 and below in the same month. Click here for full Terms and Conditions. Click here for Frequently Asked Questions.

Say goodbye to foreign currency transaction fees and hello to a convenient and safe way to spend when travelling!

Pay for shopping, dining and leisure with your DBS Visa Debit Card in up to 11 foreign currencies with no foreign exchange fees.

Simply link your My Account as the primary account to your DBS Visa Debit Card. Your foreign currency transactions/withdrawal will be debited directly from the respective foreign currency wallet in your My Account.*

There are 11 available foreign currencies:

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Euro (EUR)

- Hong Kong Dollar (HKD)

- Japanese Yen (JPY)

- New Zealand Dollar (NZD)

- Norwegian Kroner (NOK)

- Sterling Pound (GBP)

- Swedish Kroner (SEK)

- Thai Baht (THB)

- US Dollar (USD)

Do note that Renminbi Offshore (CNH) is not available for the card feature.

*Important notes:

- Your My Account’s foreign currency wallet must contain sufficient funds prior to making a transaction. Only then will your transaction be automatically debited from the respective foreign currency wallet without any foreign exchange conversion fees.

- Ensure that your DBS Visa Debit Card is primary linked to your My Account and the correct currency is selected at point of transaction.

- In some cases, depending on how the merchant processes your transaction, your transaction may be billed to you in another foreign currency other than the local currency.

- Generally, overseas ATM withdrawals will be automatically deducted from your primary account. However, if prompted, please select "Checking/Current Account" to withdraw foreign currency cash overseas from your My Account using your DBS Visa Debit Card.

Exchange currencies, pay zero overseas fees, and earn cashback easily!

Simply set up your travel wallet by making your DBS Multiplier or My Account the primary account linked to your DBS Visa Debit Card.

Learn more about your travel wallet.

For digibank mobile, please:

- Log in to digibank mobile

- Upon successful login, tap “More”

- Under “Manage Cards & Loans”, select “Link Card to Account”

- Select the DBS Visa Debit Card you wish to primary link your My Account

- Verify the details and tap “Confirm” to complete the card linkage

For digibank Online, please:

- Log in to digibank Online

- Under “Cards”, select “Link Card to Deposit Account for ATM Use”

- Select the DBS Visa Debit Card you wish to primary link your My Account

- Verify the details and click “Submit” to complete the card linkage

Tap and SimplyGo on buses and trains without having to top-up. You can also access your travel history and transactions anytime and anywhere via the TransitLink SimplyGo Portal or TL SimplyGo mobile app.

Click here for more information.

More Info

The default daily limits set on your NETS Transactions, ATM Withdrawals and Debit Card Spend Transactions are set at S$5000, S$3000 and S$2000 respectively.

To find out what are the current daily spend/NETS/withdrawal limits on your debit card and to revise these limits, you may do so via Digibank. Find out more on how to update ATM/Debit Card Limits here.

The total amount of cash that you can withdraw per day at both local and overseas ATMs is capped. This daily cash withdrawal limit applies regardless of the number of cards you have. Click here for details.

If you prefer to only use your Visa, MasterCard or UnionPay Debit card(s) for PIN-based NETS and ATM transactions and would like to disable the contactless feature, you may do so on digibank. Find out more on how to customise your Card Functions here.

Disabling the contactless feature will not affect your NETS and ATM transactions.

Control and protect your cards with Payment Controls on digibank.

You may enable/disable the magnetic stripe on your card(s) via digibank or any DBS/POSB ATM in Singapore:

The risk of unauthorised transactions occurring on the Card is higher when the magnetic stripe is enabled for overseas use, as the magnetic stripe information can be easily copied.