![]()

If you’ve only got a minute:

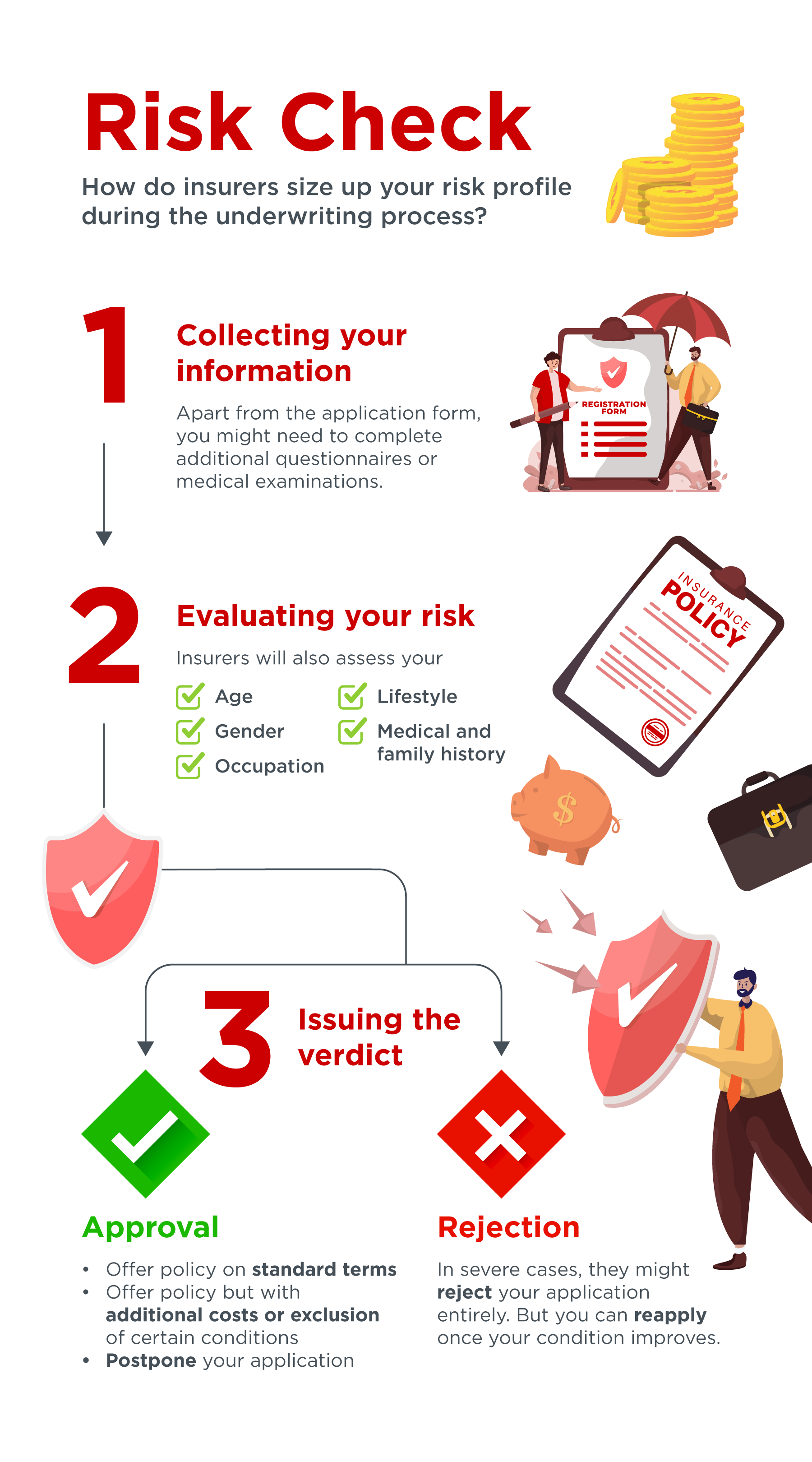

- No matter the type of insurance cover, insurers will undertake an underwriting process to assess your risk profile, which determines your premiums and coverage.

- Based on their assessment, insurers will decide whether to offer you standard terms, adjust them, or postpone or decline your application entirely.

- Although insurers operate on fairness, the outcome of an application will still vary depending on their risk appetites and personal underwriting guidelines.

![]()

That sudden crick in your knee, less-than-ideal blood sugar or cholesterol levels, perhaps even an unexpected stay at the hospital – life catches up with everyone eventually.

Choosing the right insurance plans is therefore crucial in providing a financial safety net for both you and your loved ones, and ensuring that hefty medical bills do not massively disrupt your way of life during challenging times.

And yet, it is possible for individuals to submit an insurance application only to be covered for less than they had expected. Insurance policies often come with terms and conditions that may not be immediately apparent to you, and these are determined by insurers’ meticulous assessment of a range of factors through a process known as underwriting.

Familiarising yourself with the ins and outs of underwriting can help you understand how the information you disclose about your health affects your coverage and the premiums you pay.

What is medical underwriting?

Whether it's life insurance to protect loved ones or health insurance to cover your personal medical expenses, insurers undertake the process of underwriting to evaluate the risk of insuring someone and decide how much they should pay for coverage.

Though the terms and conditions may vary widely across different insurance policies, insurers conduct the underwriting process according to the same set of principles, no matter the type of medical condition they are dealing with. This is to ensure a fair and consistent approach towards risk assessment.

Insurers evaluate each case according to a person’s risk profile as objectively and holistically as they can, based on factors such as age, gender, occupation, medical and family history, lifestyle, and more. This is done based on the medical evidence and information that you provide, such as the results of a medical report. Finally, they set an amount for you to pay, known as a premium, that they believe matches your associated level of risk.

That said, while insurers may prioritise the same principles of fairness and objectivity, they still have their own underwriting guidelines and risk appetite, meaning that underwriting outcomes may still differ from insurer to insurer.

How does the underwriting process work?

1. Submission of application

The underwriting process begins from the moment you submit your application form, which serves as the insurer’s main source of information. Sometimes, they may ask you to provide additional information for them to assess your risk profile more accurately, based on what you have declared.

For example, if you declare that you have asthma, you may need to complete an asthma questionnaire or undergo additional medical examinations by the insurer’s panel of doctors. The insurer may bear the costs of these extra examinations.

2. Assessment by insurer

When insurers review your application, they look at how serious your medical conditions are and what kind of coverage you're applying for, among other important factors. Someone whose diabetes is not being managed well and is not receiving treatment from a doctor is likely to be identified as a high-risk profile, as his condition can worsen and result in future complications like organ damage.

3. Insurer’s decision

After an insurer has finalised his or her evaluation, 1 of 4 outcomes is possible:

- Offer standard terms: If an insurer categorises you as having a standard risk profile, your application will be accepted and you will be charged the standard premium without any extra costs. This is the typical outcome for most applicants.

- Offer with loading and/or exclusions: Sometimes, an insurer might not accept your application under standard terms due to factors like pre-existing medical conditions, but they may offer the policy with added costs (known as loading) or exclude certain conditions from coverage. You can choose whether or not to take up the revised terms of the policy. If you have previously accepted policies with loading or exclusions, you can submit updated medical evidence for reassessment.

- Postponement: An insurer may delay processing your application if, for example, you are due for surgery that they deem as high-risk.

- Rejection: If your risk profile is deemed unacceptable by the insurer, they will decline your application. This typically applies to severe cases, such as uncontrolled hypertension. However, you can reapply once your condition improves.

To put everything in context…

Consider the case of a 50-year-old non-smoker who has been on medication for high blood pressure and high cholesterol for the past 5 years.

With this amount of information, it may be insufficient for an insurer to conduct a fair and accurate risk assessment. The insurer may then ask him to undergo a medical examination and blood test, as well as provide 3 years’ worth of medical reports from his current doctor to give more specific details of his condition.

Assuming that all tests show no abnormalities and the medical reports show consistently normal readings, life, total and permanent disability, and critical illness coverage can likely be offered with favourable terms. While his blood pressure and cholesterol levels may be well-controlled with medication, the possibility of hospitalisation is still higher than an average person’s with these conditions. Hence, hospitalisation cover may be offered with some loading (additional premiums) or exclusion, depending on the insurer’s risk appetite.

When you stay informed, you stay protected. Understanding how underwriters assess risk gives you greater confidence and security in making decisions about your insurance needs.

Note: This article was adapted from Life Insurance Association Singapore’s Guide to Medical Underwriting for Life Insurance 2024.