Homecare costs and healthier living

By Shawn Lee

![]()

If you’ve only got a minute:

- From October 2023, homebound patients will be able to tap on their MediSave for MOH-funded home medical and nursing providers.

- With telehealth services gaining momentum, MOH will be extending subsidies and the use of MediSave for home palliative care services from July 2023 and for chronic disease management later this year.

- Healthier SG, a national initiative to promote preventive health, has been launched in July 2023 starting with Singapore Citizens and Permanent Residents aged 60 and above. Those aged 40 to 59 will be invited to join later this year.

![]()

Did you know that by 2026, Singapore is projected to become a "super-aged" society, with one in five people aged 65 and above?

It's a significant shift that will require innovative solutions to cater to the healthcare needs of our aging population.

There are some exciting updates that will make a positive impact on your healthcare experience, particularly if you require home medical and nursing services.

Seamless Access to Funding: Utilising Medisave for Home Medical and Nursing Services

If you or your loved ones are homebound patients, you may be faced with the challenge of accessing funds for your healthcare needs. Due to limited mobility, visiting polyclinics or hospitals might not be feasible, leading you to opt for home care instead. However, tapping into your MediSave account for these services has not been possible—until now.

Starting from 1 October 2023, the Ministry of Health (MOH) will enable seamless access to funding healthcare costs across different settings. MOH-funded home medical and nursing providers, such as the Home Nursing Foundation, NTUC Health, and SATA CommHealth, will now be able to submit MediSave claims for patients who are homebound. This means that you can tap into your MediSave just as you would for medical services in clinics, providing you with financial flexibility and a peace of mind.

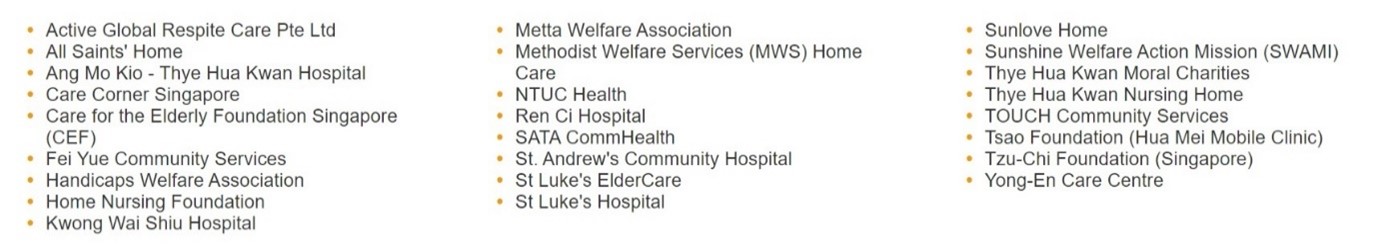

List of MOH-Funded Home Medical and Home Nursing Service Providers

Source: Agency for Integrated Care (AIC), as of 5 July 2023

The usage of MediSave will eventually be extended to other non-MOH-funded home medical and nursing providers, broadening the options available for patients requiring home-based care. This aims to ensure that everyone has equal opportunities to access the care they need, regardless of the provider they choose.

Financial Support for Telehealth: Expanding Subsidies and MediSave

The rise of telehealth has revolutionised how we access healthcare services. With just a mobile phone or laptop, you can now conveniently connect with healthcare practitioners from the comfort of your home. This approach saves you time and cost, as you no longer need to travel to physical healthcare facilities.

Recognising the value and convenience of telehealth, MOH has extended subsidies and the use of MediSave for home palliative care services from 1 July 2023. This caters to individuals with advanced illnesses who require greater support.

Additionally, later this year, MOH plans to extend subsidies and MediSave usage to include tele-consultations for chronic disease management. This is particularly useful for individuals with conditions like diabetes, high cholesterol, and high blood pressure. By offering tele-consultations as an option, MOH aims to empower patients to take control of their health while minimising unnecessary visits to healthcare facilities.

Promoting Healthier Living: Introducing Healthier SG

Prevention is always better than cure, and to support Singaporeans in managing their health and preventing the onset of chronic diseases, MOH has launched Healthier SG—a national initiative focused on preventive health.

Instead of visiting multiple healthcare providers, Healthier SG encourages you to build a trusted relationship with your chosen family doctor. Together, you'll develop a personalised health plan that encompasses your goals, health screenings, and relevant vaccinations. This comprehensive approach aims to detect potential health issues early and effectively manage them.

Choosing a family doctor ensures that you receive dedicated, long-term care from someone you trust. Your doctor will also recommend lifestyle adjustments and community physical activity programmes tailored to your needs, helping you sustain healthier habits in the long run.

Starting from July 2023, the Healthier SG enrolment programme will commence with Singapore Citizens and Permanent Residents aged 60 years and above. If you fall into this category, keep an eye on your SMS inbox, as you will receive an invitation to enrol via the HealthHub app. Through the app, you can select your preferred Healthier SG clinic and book an appointment for your free first Health Plan consultation. For those aged 40 to 59 years, worry not! You will be invited to join the programme later.

There are additional benefits: after your first health plan consultation, you will earn S$20 worth of Healthpoints in your Healthy 365 app. On top of that, Singapore Citizens will receive fully subsidised nationally recommended screenings and vaccinations. It's a win-win situation—improving your health while earning rewards.

These updates pave the way for a healthier future for all of us. It's not just about living longer; it's about living well, with good health, time, and financial security. By embracing these advancements, you can make the most out of your retirement years and enjoy the freedom to pursue your passions and dreams.

The future of healthcare in Singapore is evolving, and you have the power to take advantage of these opportunities. Whether it's utilising Medisave for home medical, nursing services and telehealth or embracing Healthier SG, these initiatives are designed to empower you to live a healthier and more fulfilling life.

So, get ready to embark on this journey towards better health and well-being. Your future self will thank you for it!

DBS has partnered with major insurers in Singapore to make health insurance easily accessible online for purchase. You can now independently learn, compare, and buy a plan most suited to your own needs. Find out more on DBS Health Marketplace.

Ready to start?

Check out digibank to analyse your real-time insurance coverage. The best part is, it's fuss-free - we automatically work out your gaps and provide planning tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)