Common Regrets over First Insurance Purchase

![]()

If you’ve only got a minute:

- Don’t buy insurance solely because of your “friend” who is a financial advisor. Rather, focus on the product and the benefits (i.e. protection) that it provides.

- Getting a bundled coverage may be a good way to start because it covers your protection needs across a range of risks.

- You don’t have to go big on your first insurance purchase. Always start with coverage that you need and can afford. It is also important to review your coverage regularly when you can.

![]()

Buying your first insurance can be a difficult decision. You may not be sure of what to expect and unaware of the pitfalls to avoid. That’s why we have put together some common regrets that young adults often lament after they’ve made their first insurance purchase so that you can avoid them during your first insurance purchase.

Buying from your “friend”

Most of us make our first insurance purchase after entering the working world. Often, the person whom we buy insurance from is likely to be a friend who has joined the insurance industry as an insurance agent or financial advisor.

There are various reasons why you may prefer to buy financial products from someone you are familiar with. Having a close friend whom you can trust to take care of your financial well-being is one of them.

But the reality is that some of us may be approached by friends who are financial advisors and they are acquaintances whom we have lost touch for years. They could possibly have reached out to us so that they could close a sale to hit their sales quotas. Some of us are simply too embarrassed to reject them and end up buying an insurance policy from them.

As such, you end up in an endless loop where your “friend” will continue to upsell more insurance products. There could also be more problems if and when your friend quit the insurance industry, leaving you to deal with a new agent These are the exact kind of scenarios that we want to avoid.

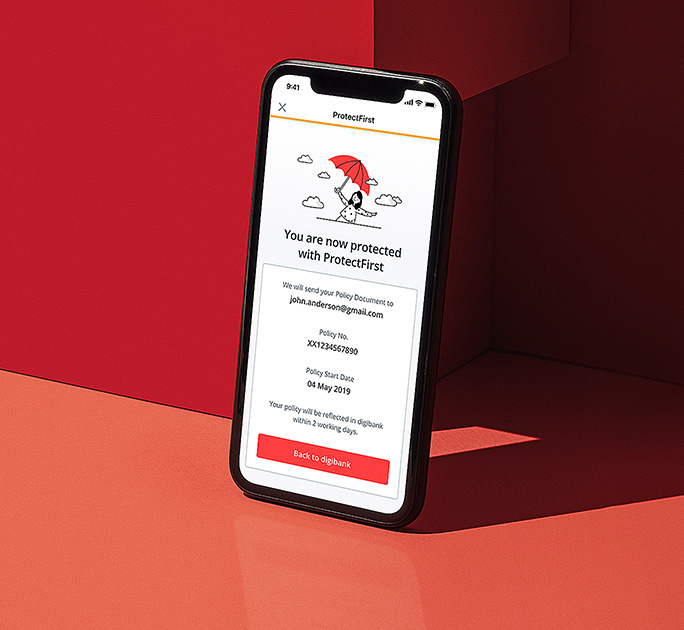

With the growth of digital insurance, you can buy your first insurance online without having to go through any financial advisor. ProtectFirst, distributed by DBS and underwritten by Manulife, is a digital insurance plan that offers great convenience.

Young and invincible: nothing will happen to me

Young adults tend to believe that they can go without insurance because they are young and healthy, and nothing will happen to them. Well, they may feel that way about themselves, but that may not be the reality.

Deaths, accidents or critical illnesses do not pre-select their targets based on age. This means that any of these events can strike us anytime. And that’s precisely why we want to get ourselves insured early while we are still healthy.

Getting an insurance cover that doesn’t suit your needs

You may have heard from your friends or family members complaining that their insurance coverage isn’t good because they were denied a claim, believing that it was due to the insurance company trying to wriggle its way out of paying the claim. In reality, the reason for the unsuccessful claim was because the insurance was not meant to cover that particular protection need.

For instance, if you tried to make a death claim on a health insurance plan, it doesn’t work because health insurance is not meant to protect your life but to help defray your hospitalisation cost. At the core of this is that, as consumers, we sometimes end up regretting our first insurance purchase because we were not clear about the objectives of buying the insurance. So we may end up buying an unsuitable insurance plan when clearly there is another plan which is more aligned with our needs.

For young adults, getting your first insurance plan right is important to ensure that you maximize the limited budget that you have. Digital insurance like ProtectFirst is a good starter pack for your basic protection needs as it provides coverage against big 5 critical illnesses (including early stage), life protection and serious accidents. Nevertheless, do remember to review your insurance needs regularly and ensure that your protection gaps are adequately addressed when you have the budget.

If you are unsure on how to start your protection journey, ProtectFirst makes taking that first step easy for you. Simply choose from one out of the three plan types which best describe yourself, with each plan providing a different level of coverage for the respective benefits.

Worries about affordability

Another concern for young adults is the lack of budget for insurance. This is especially so if you want to get yourself adequately covered once you start working. Having more coverage naturally means you will have to pay more premiums, which is not a luxury you may have at the start of your career.

In addition, insurance premiums do take up some proportion of the monthly budget that you have for other expenses or goals. For instance, you may have more immediate savings goals or purchases that you want to fulfil, which makes paying for insurance seem like an opportunity cost.

As such, some of us may put off plans for getting ourselves adequately covered until we are ready for the “right one”, i.e. until we are able to afford the premiums for the adequate coverage.

Well, that may be true in the past, but there are insurance plans like presently that allow us to start small with lower cover at affordable premiums.

With ProtectFirst, you get to choose a plan to suit your lifestyle and life stage needs. With premiums from as low as S$5/month (regardless of age), it is designed with young adults in mind to help keep premiums affordable. You can also add cover by buying another ProtectFirst plan to complement prior ProtectFirst plan(s) that you have bought when you have additional budget, to address your protection shortfall.

In Collaboration with Manulife

ProtectFirst is issued and underwritten by Manulife (Singapore) Pte. Ltd. ("Manulife") (Reg. No. 198002116D) and distributed by DBS Bank Ltd ("DBS").

Ready to start?

Check out digibank to analyse your real-time insurance coverage. The best part is, it's fuss-free - we automatically work out your gaps and provide planning tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)