Is Dependants’ Protection Scheme (DPS) enough?

By Lorna Tan

![]()

If you’ve only got a minute:

Here are things you should know about DPS and how to use it to complement your financial planning:

- DPS premiums rise gradually beyond age 35 and cover ends at age 65

- DPS has less flexibility and does not offer limited premium payment mode

- Consider the opportunity cost of using CPF savings for DPS premiums

- Work out your term coverage and consider boosting your overall cover by adding other term plans.

![]()

Most of us are insured under the Dependants’ Protection Scheme (DPS) which is an opt-out term insurance scheme administered by Great Eastern. Central Provident Fund (CPF) members are automatically included under DPS if they are a Singapore Citizen or Permanent Resident, between ages 21 and 65, and have made their first CPF working contribution.

A comparison with other term plans indicates that while the DPS is simple to understand, the coverage is basic and usually insufficient especially if you have dependants or are servicing a home loan. After all, the aim of this scheme is to provide insured members and their families with some money to tide over the initial period should the insured members pass away or suffer from Terminal Illness or Total Permanent Disability. The recent enhancements (reduction in DPS premiums and higher sums assured) to the scheme in 2021 has made it more competitive, relative to other terms plans in the market.

For members up to age 60, the maximum sum assured is S$70,000 while it is S$55,000 for those between the ages 60 and 65. The cover ends when the member reaches age 65 or when there is an eligible claim, whichever is earlier. DPS also offers the convenience of having its annual premiums deducted from our CPF Ordinary or Special Accounts, so it does not require out of pocket cash.

Still, the DPS policy may lapse due to non-payment of premiums which has happened to some CPF members when their CPF savings run dry and they forget to use cash to fund the premiums.

5 things you should know about DPS

1. DPS premiums rise gradually beyond age 35

One advantage of DPS is the financial protection provided at affordable premiums. However, most people do not realise that the DPS premiums are not level and they increase gradually when the insured member reaches 35. For instance, the annual premium stands at S$18 for those below 35 and it goes up to S$30 at the next age band of 35 to 39. The premiums rise to S$50 from ages 40 to 44, and to S$93 from ages 45 to 49. When the member reaches 50 to 54 the premium stands at S$188, and it jumps to S$298 from ages 55 to 64. This translates to total premiums of S$5,019 assuming the cover starts at age 21.

Dependants' Protection Scheme

|

Age (as of payment date) |

Yearly Premium for $70,000 sum assured |

|---|---|

| 34 years and below | S$18 |

| 35 – 39 years | S$30 |

| 40 – 44 years | S$50 |

| 45 – 49 years | S$93 |

| 50 – 54 years | S$188 |

| 55 – 59 years | S$298 |

| 60 – 64 years | S$298 (for sum assured of S$55,000) |

Source: CPF Board

2. DPS cover ends at age 65

The statutory retirement age in Singapore stands at 62 and is set to rise to 65 in year 2030 while the re-employment age will be raised to 70 by end of 2030. As the DPS only covers insured members up to age 65, they need to consider that the DPS is unable to cover them while they are still working beyond 65.

On the other hand, most term plans offered by private insurers cover the insured up to age 70 and there are a few plans that extend the cover till age 99. This may be an important factor for those who are planning to continue working beyond the statutory retirement age or require the cover beyond age 65.

3. DPS does not offer limited premium payments

DPS requires the premiums to be paid annually whereas most term plans in the market allow more flexibility in that you can choose to pay your premiums over a shorter specified period.

4. DPS has less flexibility

There are some benefits offered by other term insurance plans that are not found in the DPS. They include the guaranteed conversion to a whole life or endowment plan, guaranteed renewal privilege and the option to include riders that cover critical illness or accidental death.

For example, ManuProtect Term may be converted to any available regular premium life insurance plan (whole life, endowment or investment-linked) offered by Manulife without providing evidence of health while the policy is in-force and before the insured turns 65. After the conversion, there will be cash value for the policy unlike traditional term plans.

There are also a few term plans such as ManuProtect MoneyBack that offers full refund of premiums upon policy maturity assuming no claims were made.

5. Opportunity cost

DPS premiums are usually paid from our CPF savings unless you opt to change the premium payment mode. As our CPF Ordinary Account attracts up to 3.5% pa and the CPF Special Account yields up to 5% pa, there is an opportunity cost in using them to pay for DPS premiums.

Steps to take

1. Work out your term coverage

Generally, term insurance is usually less expensive when compared to whole life insurance as there is no cash value when the plan matures. Term insurance is a useful plan to replace loss of income for the family and dependants when the main breadwinner is no longer around or unable to work. Do ensure that both the policy sum assured and the policy term are sufficient to cover the amount and the period that the income is required by dependants or for a loan’s outstanding period.

Take into consideration when your child will complete university, or when the housing loan is fully redeemed, and/or when you expect to retire. You can also opt to stagger your term policies which can come with varying sums assured.

2. Stay with DPS and consider other term plans

For CPF members who wish to maintain their DPS cover, it is prudent to look for other term insurance plans to boost their cover in terms of the sum assured and for a longer duration, depending on their financial situation.

For example, if you are servicing a mortgage, do ensure that you have sufficient insurance cover against death and terminal illness to cover the loan amount. In addition, there are also benefits in most term plans that are not available under DPS.

For instance, the annual premium for a 25-year-old male under Manulife’s ManuProtect Term plan amounts to S$208.50 or a total of S$7,297.50 for 35 years till he reaches age 60 for a higher sum assured of S$150,000. And for a sum assured of S$1 million, the annual premium would be S$817 till age 65.

3. Terminate DPS and buy a term plan

Some CPF members may prefer to terminate their DPS early and buy term plans from private insurers which cater optimally to their needs. If you do so, do ensure that you do not miss out on your premium payments. To avoid the risk of lapsing your plan unknowingly, consider arranging for such deductions automatically via Giro or a credit card. In the case of DPS, it is highly unlikely for CPF members to miss out on premium payments as they come from their CPF savings.

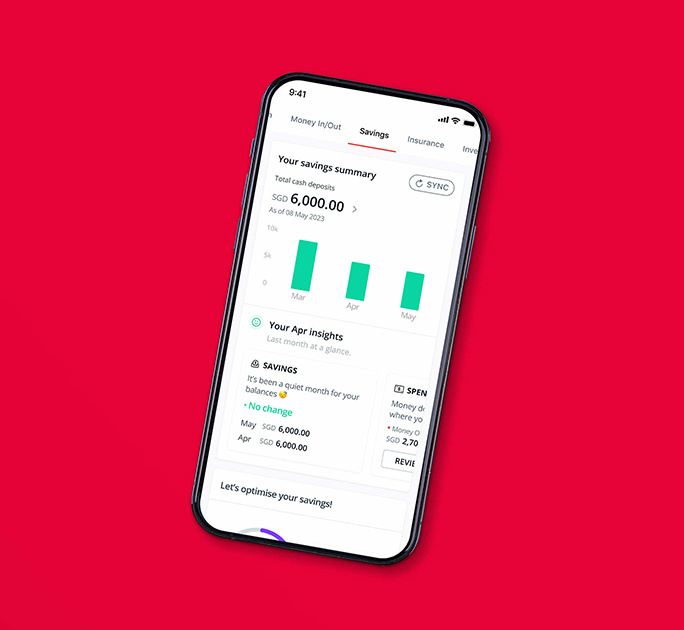

Ready to start?

Check out digibank to analyse your real-time insurance coverage. The best part is, it's fuss-free - we automatically work out your gaps and provide planning tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)