Investing along the economic cycle

![]()

If you’ve only got a minute:

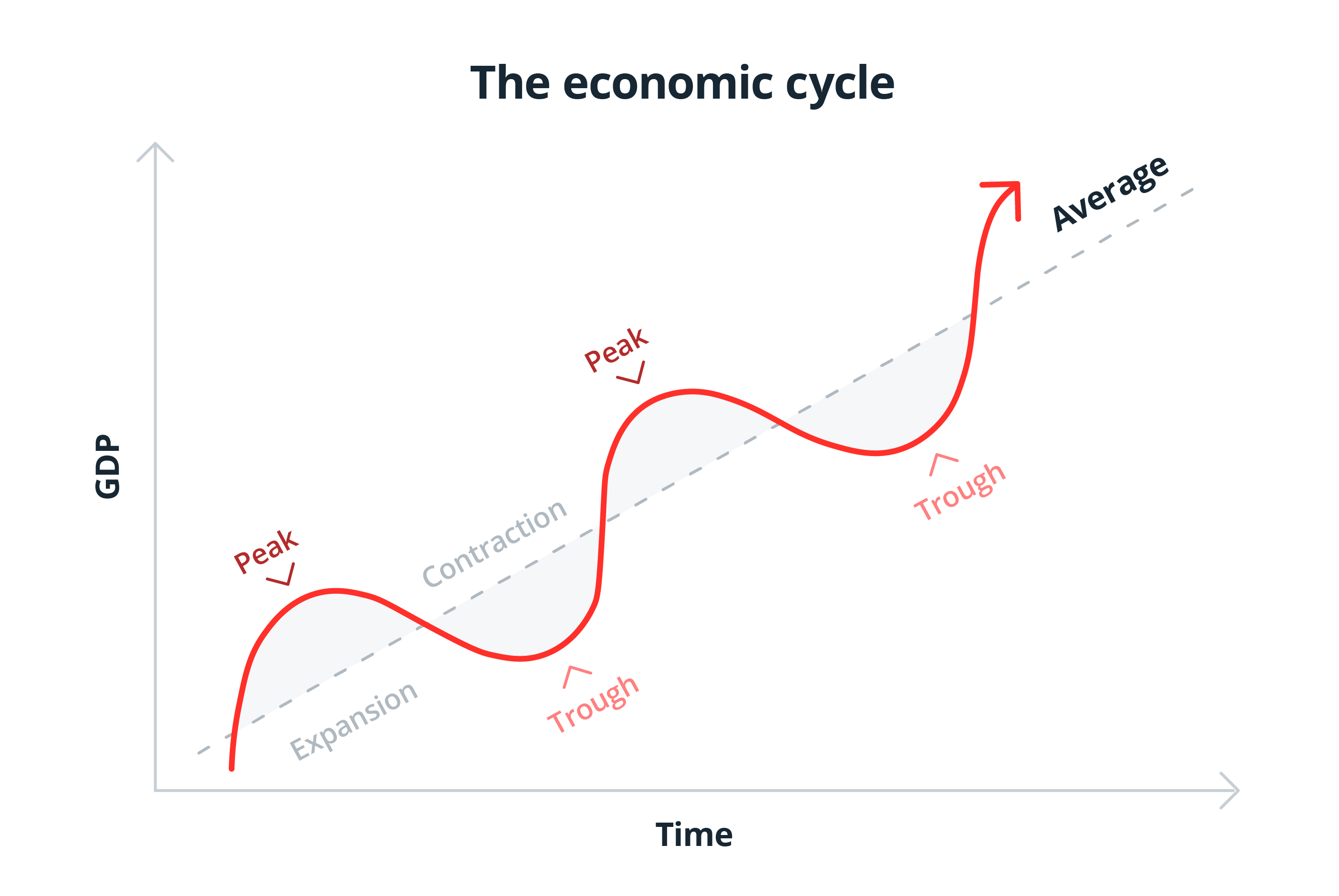

- There are 4 main phases of an economic cycle: Expansion, Peak, Contraction, and Trough.

- Understanding how different asset classes and sectors perform in each phase of the economic cycle can help to strategically optimise your investment portfolio.

- Adopting a long-term and diversified investment approach enables you to ride out the different phases of the market cycle by reducing your overall risk exposure.

![]()

Ocean waves, sculpted by wind and sometimes influenced by tides, rise and fall in a rhythmic cycle. In a similar pattern of rising and falling, the economy experiences growth and decline known as expansions and contractions. These movements are defined by fluctuations in economic activity like employment, income, sales, and interest rates among others.

While the economic cycle tends to follow a pattern, pinpointing the exact moment it moves from one phase to the next is a lot easier said than done.

Recognising the different phases of the cycle and how various investment assets perform within each of them is key for investors. This can help you to strategically plan your portfolio to maximise your potential returns while mitigating your risk exposure by planning ahead of each phase.

Understanding the waves

Here are the 4 phases in the economic cycle and what characterises them.

1. Expansion

The expansionary phase begins after the economy hits a trough, from which it starts to recover and then grow, culminating in a peak.

It is helpful to understand that much of the work by policymakers to stimulate growth is done before this phase. For example, when economic performance is dipping, central banks may stimulate the economy by lowering interest rates. Such moves are often made during a recession or even before that.

In 2020, the Covid-19 pandemic lockdowns and business closures triggered a deep economic downturn. In response, the US Federal Reserve cut interest rates down to the 0% to 0.25% range in March 2020 to support the economy. Lower interest rates make it cheaper for consumers and businesses to borrow money. For consumers, this means less costly mortgages and personal loans, making it easier for people to spend on necessities and goods, which in turn, spurs economic growth.

For businesses, the ease of cashflow enables them to spend more on investment and expansion to meet the rising demand from consumers. This gives rise to higher employment, income, and sales, thus stimulating economic growth.

2. Peak

Just like most things in life, good times don’t last forever. The prospering economy eventually reaches a peak and starts to plateau as it reaches its maximum capacity to meet the demands of the people and businesses.

It is at this stage that production, employment, income, and spending, tend to be at a high. This can lead to an overheated economy where increased consumer wealth and spending results in high levels of inflation.

To curb inflation and cool the economy, central banks may step in by raising interest rates to make borrowing more expensive. This can be seen between March 2022 and July 2023, where in an effort to bring inflation down, the Fed hiked interest rates 11 times, hitting the 5.25%-5.50% range.

The peak phase marks the turning point of economic growth, where we might see the beginning of a contraction.

3. Contraction

Just as the rising wave falls, the contraction phase is the “falling” part of the economic cycle, where activity starts to slow down.

As things become more expensive, consumers turn more cautious with their spending, especially on discretionary costs like dining out, travelling, and buying luxury goods.

The overall demand for goods and services decreases, and businesses slow their production. They may also freeze hiring or lay off workers, leading to an increase in unemployment. At this phase, some companies struggle to survive, leading to increased bankruptcies and falling consumer confidence.

While contractions are often associated with recessions, not all contractions lead to recessions. As a general rule of thumb, economists define a recession as 2 consecutive quarters of negative Gross Domestic Product (GDP) growth.

4. Trough

The trough is characterised by negative economic growth, low demand, and decreased spending. Businesses experience reduced revenue and profits, and unemployment is high. It marks the end of the contraction phase at the bottom of the economic cycle.

However, this seemingly bleak point also marks the start of the recovery period. Central banks start to ease their policies and cut interest rates to encourage growth and borrowing, and the economy transitions back to the expansionary phase, beginning the cycle anew.

Riding the waves

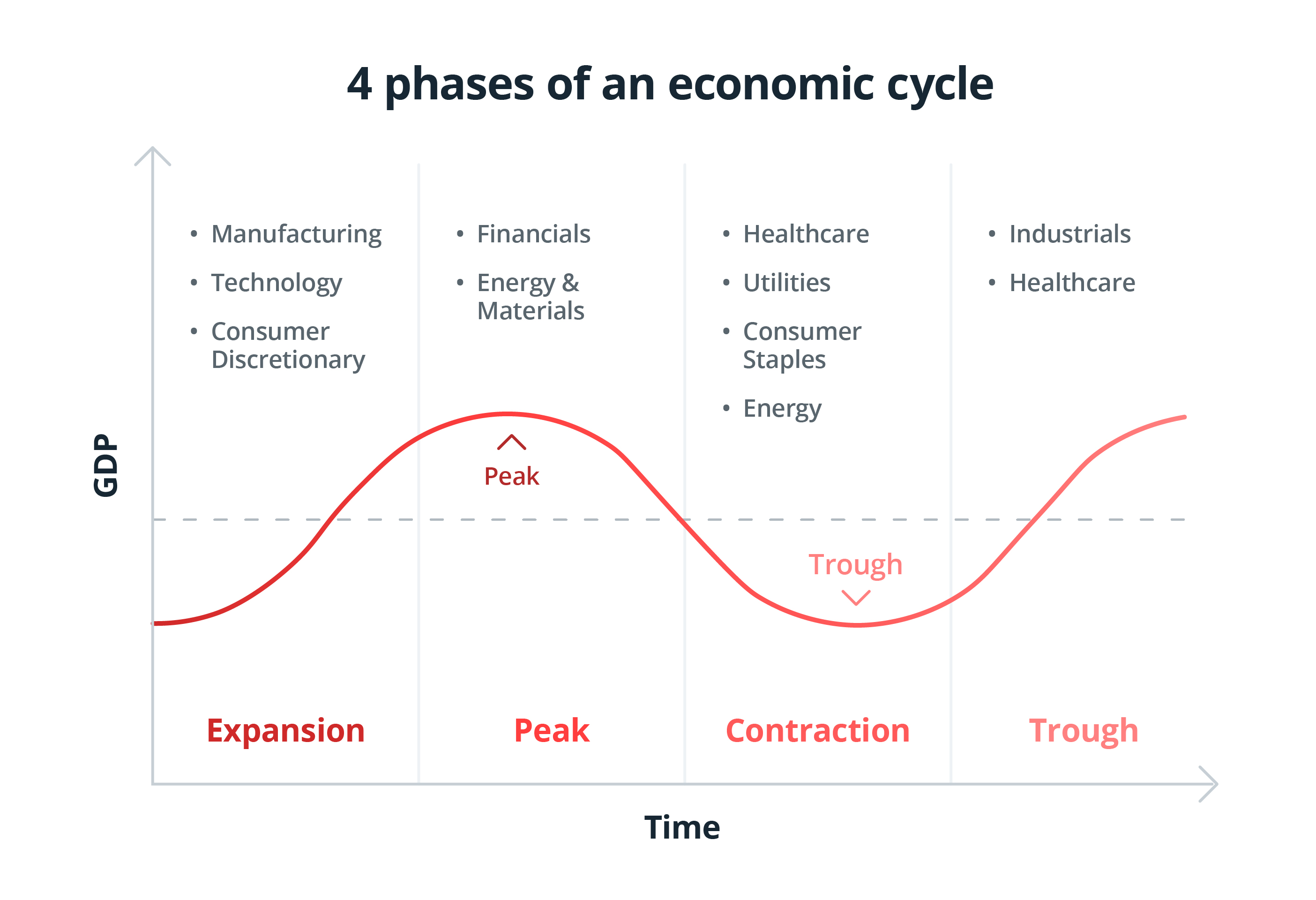

Different asset classes tend to take turns to outperform each other at various stages of the economic cycle. This provides an opportunity for investors who actively manage their portfolios to strategically plan and reallocate their investments through the expansions and downturns.

Read more: What is a core-satellite portfolio?

Investing through the expansions

In the early stages of the expansion, the economy is just recovering from a recession. During this time of growth and low interest rates, assets like equities tend to outperform bonds and cash.

When it comes to equity investing in a growing economy, sectors that drive economic expansion are likely to do well. Having more funds to spend, consumers are also likely to have higher discretionary spending (on wants, rather than needs).

With that in mind, just before coming out of the recession, investors can consider positioning their portfolios to include sectors like manufacturing, infrastructure, and technology.

As the economy moves into the mid- and late- stage of the expansion, investors can add on sectors that will do well through the upturn, like consumer discretionary goods, real estate investment trusts (Reits) and financials.

Commodities like energy and materials, which support the economy through the entire growth phase, also tend to perform well from the start of recovery through to its peak.

Exchange-traded funds (ETFs) or unit trusts can also help investors gain exposure to specific sectors of the economy while providing the benefits of diversification.

As the economy grows, interest rates tend to rise. When this happens, existing bonds become less attractive while newly issued ones will be more attractive, given their higher coupon rates. Retail investors can also consider bond ETFs and unit trusts for diversification.

Nearing the peak of the expansion, stock valuations tend to be high and the market may see some price corrections. Those with a lower risk appetite may choose to take defensive positions in anticipation of the economic slowdown ahead by keeping their funds in cash or money market funds. This may help to protect against market volatility and provide liquidity for opportunities that may come later on.

Read more: Tips to pick quality dividend stocks

Investing through the downturns

Investors tend to be more cautious, shifting away from stocks to safe-haven assets, like fixed income, government securities, or cash. These investment assets tend to fare better during recessions as they provide a stream of stable income in the form of coupons and provide a hedge against market volatility risks.

Those who prefer to hold on to cash can consider placing it in cash-alternatives like Singapore Savings Bonds, T-bills, high-yield savings, or fixed deposit accounts.

With SaveUp, DBS digiPortfolio offers a ready-made investment portfolio that provides a low-risk and high-quality exposure to the fixed income market. As of end-August 2024, the SaveUp portfolio was generating a yield of 5% p.a. with an investment grade credit quality and a portfolio duration of 2 years.

This may be suitable for investors with a lower risk appetite and still wish to generate higher returns than regular cash deposits.

For investors with a higher risk tolerance, the downturn might be an opportune time to keep an eye out for companies with strong fundamentals that are able to sustain relatively stable profits. Given the depressed stock prices at this time, these companies could be undervalued by the market, presenting a potential long-term investment opportunity.

Defensive sectors continue to do well through the downturns as they provide essential goods and services that people need regardless of economic conditions. These companies are often able to maintain relatively stable dividend payouts even during times of economic instability. Examples include healthcare, utilities, consumer staples and public transportation.

Do note that the list of sectors mentioned above serves as a guide and are not exhaustive. Moreover, be aware that actual performance is also dependent on the current economic situation at the time.

As with all investments, remember to do your due diligence to reviewing your holdings, risk tolerance, time horizon, financial commitments, and goals, rebalancing your portfolio as necessary.

Read more: digiPortfolio: A robo-advisor for all

Find out more about: digiPortfolio on digibank

In for the long haul

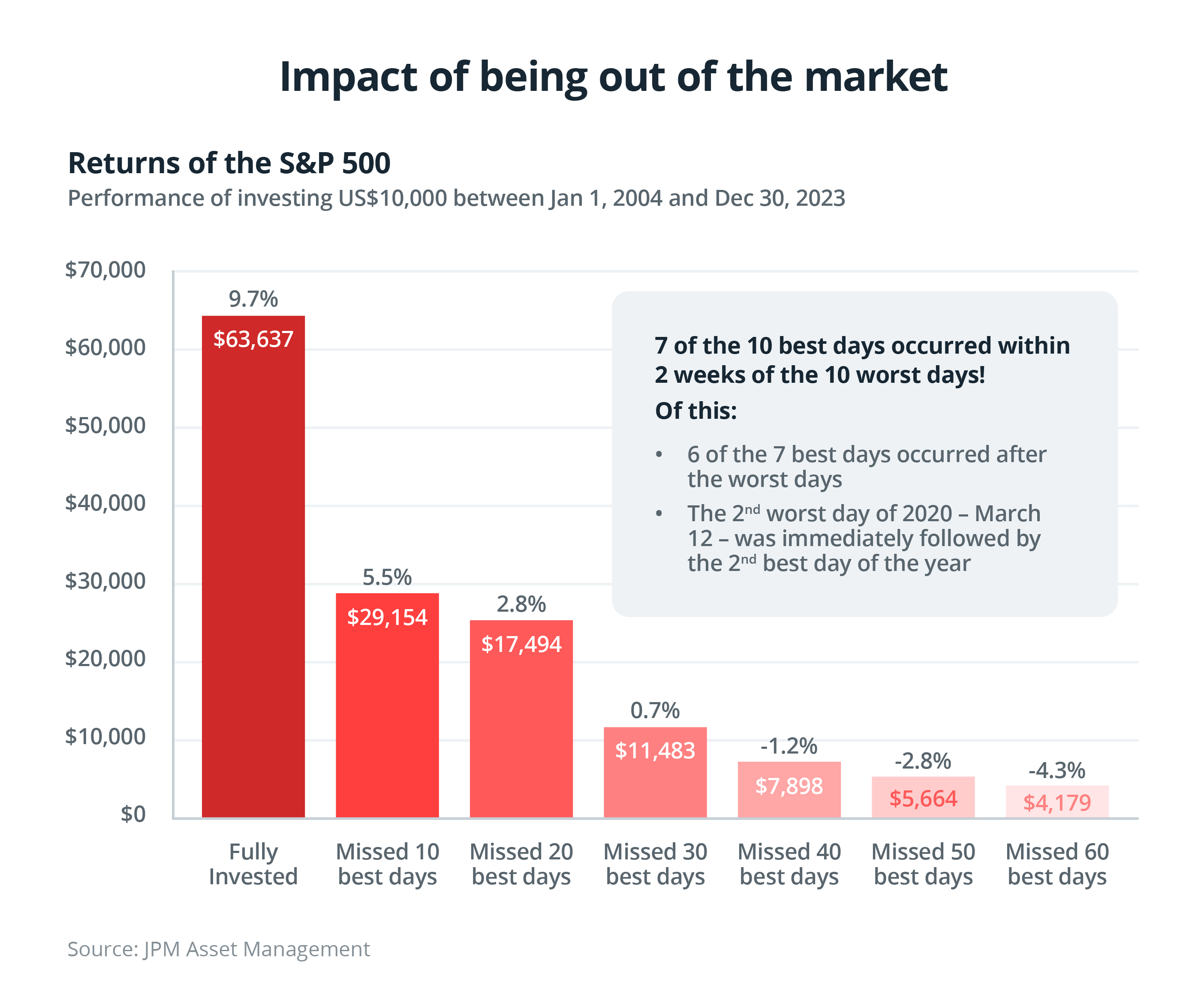

Warren Buffet, widely considered one of the most successful investors in the world, once said: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”.

Given that each exact phase of the economic cycle is impossible to predict correctly, chasing short-term gains based on market trends is unlikely to work well as a long-term solution, even for professional investors. As a retail investor, consistently monitoring the stock market and economic cycle in a bid to “buy low, sell high”, can be an arduous affair.

Instead, hold a long-term view and instead of trying to time the market, focus more on building a well-diversified portfolio and staying invested through the cycles. This is key to weathering the economic waves.

Pooled investment instruments like ETFs, unit trusts, or robo-advisors, offer diversification across multiple sectors and/or asset classes. DBS digiPortfolio helps you take the guesswork out of investing by optimising investing strategies according to the current market conditions, your risk appetite, and investment preferences.

Investment strategies which do not require timing the market, like dollar-cost averaging, are also a good way to invest during times of uncertainty. DBS Invest-Saver allows you to invest a pre-determined sum into an ETF, unit trust, or digiPortfolio monthly.

Read more: Diversify to help manage investment risks

In summary

With the perfect vision hindsight brings, we can learn how various types of investments perform along the economic cycle. This offers guidance to investors as they position their portfolio to capture value and minimise risk through the rise and fall of the economic cycle.

Remember, investing is a long-term game. Focus on building a diversified portfolio and riding the waves of the economic cycle wisely.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

Board of Governors of the Federal Reserve System “Policy Tools”, retrieved 7 Oct 2024.

Forbes, “Federal Funds Rate History 1990 to 2024”, retrieved 7 Oct 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)