By Navin Sregantan

![]()

If you’ve only got a minute:

- The investment strategy you choose must take into consideration your investment goals, risk appetite and time horizon.

- With the Barbell Strategy helps investors balance risk and reward by investing in assets at both ends of the risk spectrum: Growth and Income assets.

- Retail investors can implement the Barbell Strategy by using a combination of individual stocks, ETFs and unit trusts.

![]()

In your journey towards financial freedom, choosing which investment strategy to adopt is one of the most important decisions to make.

Even though all investment strategies aim to get the best returns, this isn’t a straightforward process as there are plenty of approaches to consider, each with its own set of pros and cons.

Your investment strategy focuses on 3 key factors that, when aligned, can help you achieve your long-term financial goals, like retirement.

After considering these factors, the next step is to determine your ideal asset allocation. This involves deciding the right mix of investments, such as stocks, bonds, alternatives, and cash, to create your portfolio.

Some investors prefer higher-risk strategies that aim for rapid growth through capital appreciation of stock prices. Others might prioritise income generation and wealth preservation, often opting for lower-risk investments.

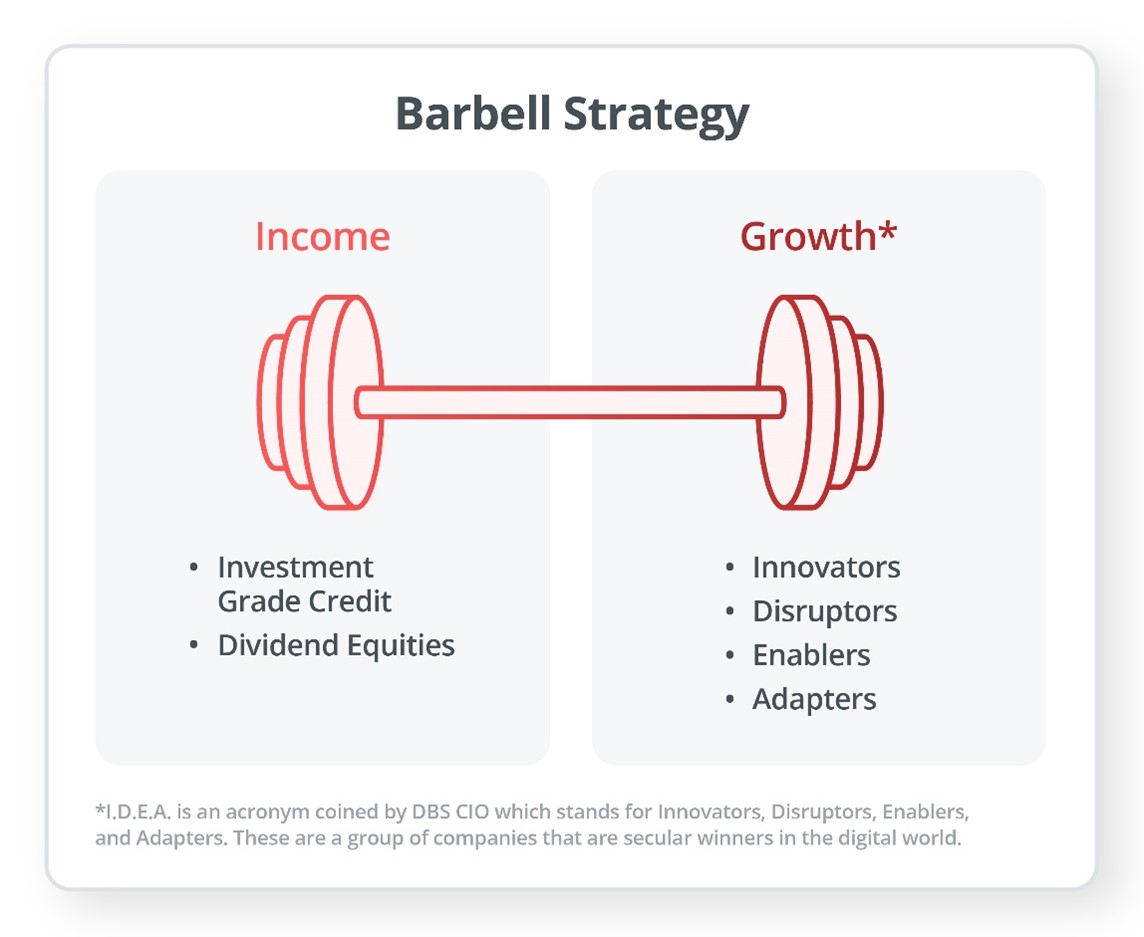

The Barbell Strategy allows you to combine both growth- and income-focused investment styles. This approach to portfolio construction has been advocated by DBS Chief Investment Office (CIO) since August 2019.

What is the Barbell Strategy?

The Barbell Strategy helps investors balance risk and reward by investing in assets at both ends of the risk spectrum: Growth and Income assets.

DBS CIO is of the view that adopting this strategy helps capture superior returns from long-term, irreversible growth trends on one hand, while generating stable income on the other hand to mitigate short-term market volatility.

The barbell approach is a flexible one. Investment portfolios can be made up of only stocks, only bonds or a combination of both asset classes along with alternative investments like Gold. Moreover, investors can tailor the strategy to suit their respective investment goals, risk appetite and time horizon.

When constructing an investment portfolio, younger investors, who tend to have a higher risk tolerance, might prioritise high-growth stocks for capital appreciation and dividend stocks for a mix of capital appreciation and recurring income when building their portfolio. This may mean allocating less than a quarter of their portfolio to bonds.

In contrast, investors nearing retirement might prioritise wealth preservation and generating stable, recurring income. Their portfolio would likely emphasise bonds and, to a lesser extent, dividend-yielding equities like real estate investment trusts (Reits) or blue-chip stocks.

Their objectives may be different, but it is important to remember that both profiles of investors are pursuing strategies that give could give them each an optimal return.

Read more: Diversify to help manage investment risks

How does it compare to a balanced portfolio?

The examples of how a barbell strategy can be employed by investors with different profiles might draw some similarities with a balanced portfolio.

As such, you might ask:

“How is a barbell strategy different from a balanced portfolio?"

In general, balanced portfolios buy a diverse range of stocks, bonds, real estate and alternatives like gold for safety. The idea behind this is to create stability by having assets with different risk-reward profiles.

Even if growth prospects are average, the asset allocation within the portfolio might not change substantially. Moreover, as no conviction exposures are taken, there is a chance that investors might get bland (though stable) market returns.

What does the barbell strategy compose of?

With the Barbell Strategy, investors can take advantage of capturing strong gains in sectors that are expected to outperform the market while balancing that risk out with income-generating investments.

In other words, investors are overweight on high-growth stocks on one end of the portfolio, and with dividend-yielding stocks and high-quality bonds on the other end.

The “Growth” Component

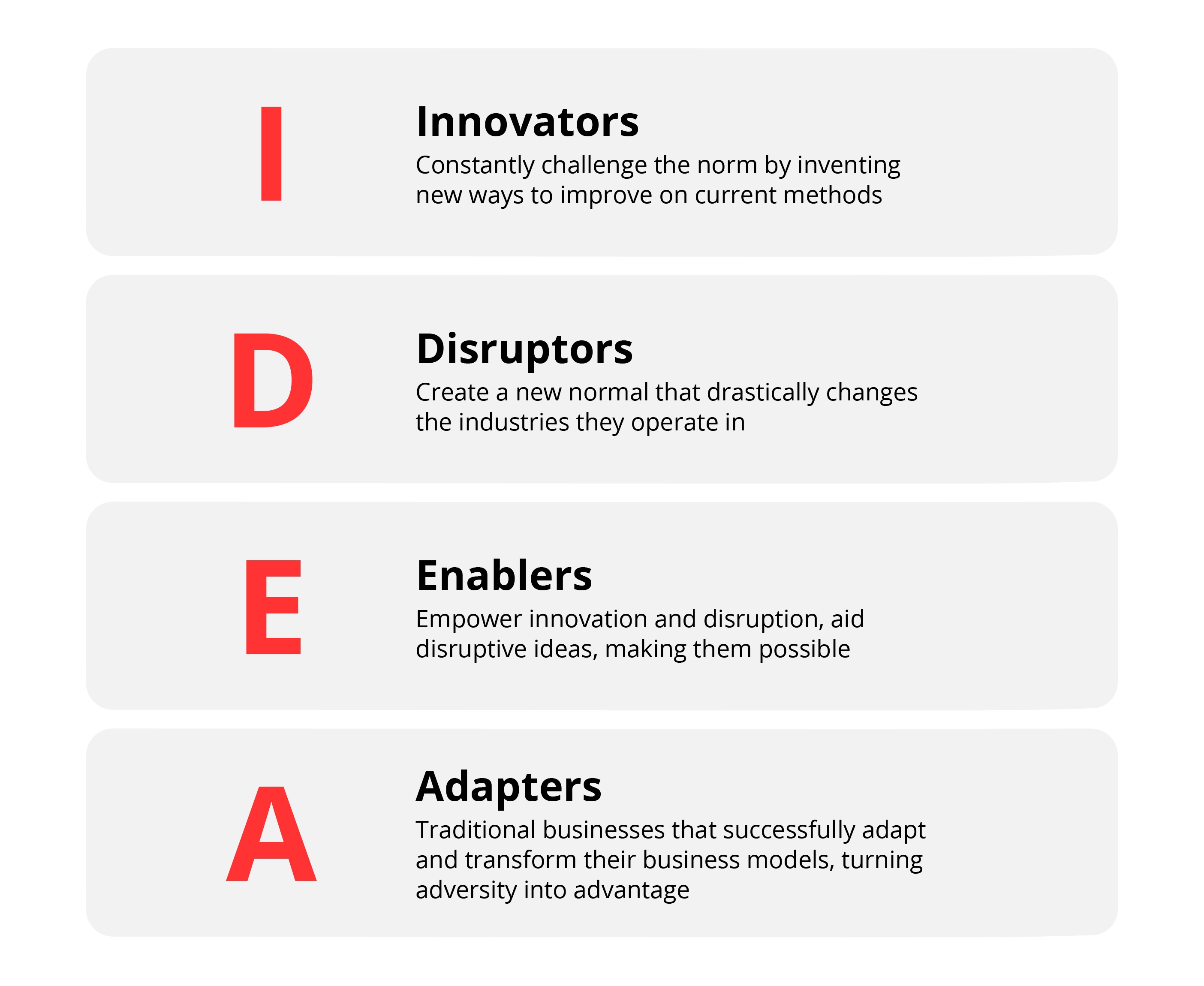

This half of the strategy focuses on investing in high-conviction secular growth trends and in particular, companies that capitalise on the global shift towards a digital economy.

Moreover, these companies are profitable, have strong earnings quality and can sustain performance resilience amid market uncertainties.

DBS CIO has coined the acronym I.D.E.A. (Innovators, Disruptors, Enablers, Adapters) for these quality growth companies.

While many of them are technology firms, there are a sizeable number of companies from sectors like Healthcare, Automotives and Insurance, among others.

That said, high growth areas often come with risks and will inevitably face volatile price movements. This why a balance is created with income generating assets.

The “Income” Component

The other half of the strategy focuses on investing in dividend equities, Reits and investment grade (IG) corporate bonds. These provide investors with a steady income stream for downside protection.

With a number of interest rate cuts expected in 2024 and 2025, investors can consider locking in higher yields in short-duration, IG bonds with a duration of 1 to 3 years to capitalise on the turn of the rate hiking cycle.

For dividend equities, focus on resilient players like large Asian financial institutions and blue-chip Singapore Reits.

How does this strategy fit into a core-satellite approach?

The core-satellite approach is one of the most accessible ways to build a well-diversified investment portfolio.

The goal of this approach is simple: Achieve market average returns with a stable “core” of long-term investments while aiming to capture above-average returns with the tactical “satellite” component.

Given the long-term, global and multi-asset focus of the Barbell Strategy, it can form the core of your portfolio (i.e. between 60% and 80% of your investible funds or capital).

Read more: What is a core-satellite portfolio?

Putting the Barbell Strategy into play

Building an investment portfolio through stock picking can be an arduous task as it often takes up a fair amount of time to research all potential companies.

One way for retail investors to simplify this process and implement the Barbell Strategy is by using a combination of individual stocks, Exchange-traded Funds (ETFs) and unit trusts.

Pooled investment products, such as ETFs and unit trusts, allow you to get diversified exposure to stocks and bonds within a specific country or sector, often with a relatively little initial investment.

To illustrate, for the growth portion of your portfolio, you could select 2 to 3 tech-focused ETFs or unit trusts. This combination would provide you with comprehensive exposure to the technology sector.

For the income half of the portfolio, exposure to real estate by purchasing an Asia-focused Reit ETF and for exposure to dividend equities, you can consider a global large-cap dividend equity fund.

If your current investment portfolio needs to be adjusted a fair bit to adopt the barbell strategy, fret not, as investment strategies are often flexible. This means that you can make changes when the current strategy does not suit your risk tolerance or schedule. That said, do expect to incur costs of adjusting the balance of your portfolio.

One way to spread to out such costs is not to rush into portfolio adjustment. Instead pick opportune times to sell your existing assets for new ones.

While this is a simplistic example of diversification, it can serve as a starting point to build up one’s investment portfolio.

Read more: Investing with only ETFs

In summary

The Barbell Strategy helps you capture long-term returns by investing in irreversible growth trends on one hand, while generating stable income on the other hand.

Regardless of which investment strategy you choose to adopt, if you are investing for the long-term (i.e. you have an investment time horizon of at least 10 years), remember that it will require discipline, time, and patience, in order to enjoy the fruits of your investments.