By Lorna Tan

Head, Financial Planning Literacy

![]()

If you’ve only got a minute:

- As Singapore interest rates typically follow US interest rates, we are shifting towards a lower interest rate environment.

- If you are planning to use your CPF monies, do note that the falling yields of T-bills may have fallen below the recommended minimum yields of T-bills invested using CPF OA and SA monies.

- For retirement planning, it is advisable to cast a longer investment horizon. More should be allocated into higher growth/risk assets to build your bases, allowing assets to work harder for you.

![]()

This article was first published in The Business Times.

After 4 years, the long-awaited US Federal Reserve rate cut happened in September. It was the first rate cut since the Covid-19 pandemic, resulting in a 50-basis-point decline in the benchmark rate to a range of 4.75% to 5% from 5.25% to 5.5%.

More cuts are on the cards with the Fed’s benchmark rate expected to head south to about 3% by the end of next year.

As Singapore interest rates typically follow US interest rates, we are shifting towards a lower interest rate environment. Even before the axe finally fell, retail investors here would have witnessed the impact of the impending rate cuts in the past few months.

The writing was on the wall, reflected particularly in the falling yields of government securities such as Treasury bills (T-bills), Singapore Savings Bonds (SSBs), and fixed deposits.

Treasury bills (T-bills)

What a contrast it was to the euphoria seen in the last couple of years, when many investors gleefully poured their savings into tranches of the sure-win and risk-free T-bills when their yields climbed along with the US rate hikes back then.

While savings accounts were at a measly 0.05% pa, T-bills yields hit a 30-year high of 4.4% in December 2022 and have since largely hovered above the 3% level.

I was no different. Together with my hubby, we channelled more than S$1 million of our CPF Ordinary Account (OA) monies into a 1-year T-bill that would mature in October. Even then, I was prepared to face a re-investment risk when it matured, because yields were expected to ease over time.

The cut-off yield for the 6-month T-bill auctioned soon after the Fed cut in September, fell to a 2-year low of 2.97%, before climbing to 3.06% for the next auction that closed on 10 October.

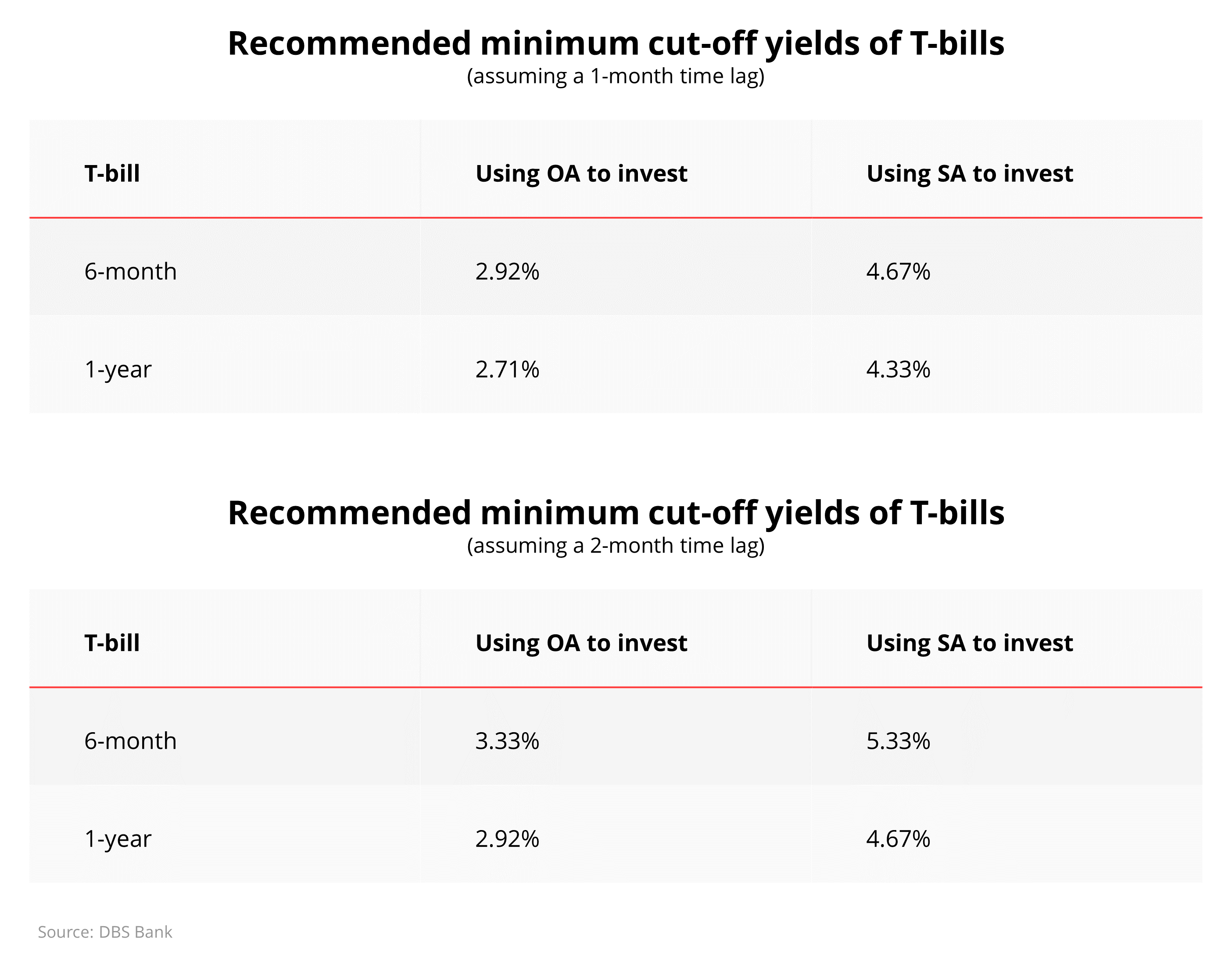

If you are planning to use your CPF monies, do note that the falling yields may have fallen below the recommended minimum yields of T-bills invested using CPF OA and CPF Special Account (SA) monies. If so, it will no longer make sense for a CPF member to invest in the instrument. He would be in a better off position by leaving his CPF monies untouched and collect the risk-free interest.

This is because CPF withdrawals in this month will not earn interest from this month onwards while CPF contributions received this month start earning interest the following month. Depending on when the deduction is done from your CPF account and when the monies are refunded to the account, you can lose up to 2 months of CPF interest.

Assuming you lose 2 months of interest, the recommended minimum yield for investing in 6-month T-bills using CPF OA is 3.33%. For 1-year T-bills, it will be 2.92%.

With S$80.3 billion worth of 6-month T-bills maturing from September to March 2025, and S$19.2 billion worth of 1-year T-bills maturing from September to July next year, it is no wonder that financial institutions and investment product providers are gearing up to provide a home for these monies.

It will be a win-win situation if they can educate retail investors on the need to diversify to suitable long-term investment opportunities that can offer more bang for their buck.

Read more: Investing in T-bills

Singapore Savings Bonds (SSBs)

For risk-averse retail investors and those who wish to park their monies in a safe, albeit low-return instrument, the SSB still has its use because it is flexible and liquid. The November SSB offers a 1-year interest rate of 2.25% and a 10-year average return of 2.56%.

But it cannot be the only product in your portfolio because it can barely help you keep up with the rising cost of living. With interest that is paid out every 6 months, the SSB value would not compound over time and grow your nest egg. Besides, the amount of SSBs that you can hold at any one time cannot exceed S$200,000.

So be wary of holding on to too much cash in low-risk products and missing out on the potential superior returns of other asset class.

Read more: Investing in SSBs

High quality bonds

For those seeking regular income payouts and higher returns than fixed deposits and government securities such as T-bills, they can consider locking in higher yields in high quality fixed income instruments like investment grade corporate bonds.

Consider deploying cash into these bonds to mitigate reinvestment risk as the rates environment is past its lofty peaks. Investors can still lock in decent yields before the Fed axe falls further.

This includes investing in bonds with a credit rating of at least BBB with a duration of 1 to 3 years to capitalise on the turn of the rate hiking cycle to minimise cash reinvestment risk. Given that short-end rates (i.e. fixed income with maturities of ≤ 1 year) are the most impacted once cuts ensue, bonds with a duration of 1 to 3 years stand to gain with more certainty from a repricing of the rate environment.

A fixed income fund that invests in a basket of bond is also an alternative, for meeting both short- and long-term goals.

Read more: A beginner’s guide to bonds

Income-generating Reits & dividend stocks

A lower interest rate environment will likely benefit Singapore’s stock market, and real estate investment trusts (Reits) are a potential market outperformer.

As the core business model of Reits revolves around leveraging debt to finance their property deals, lower interest rates should reduce financing costs and enhance profitability. This, in turn, leads to higher distributions to investors, making Reits more attractive as income-generating investments. In particular, there is value emerging for S-Reits as an important income generator with its 5% to 6% annual yield.

This is contrary to the interest rate hikes since 2022 which have led to increased borrowing costs, lower distributions to unitholders, and lower property valuations.

Another way to receive income distributions is through investing in dividend stocks, especially those of blue-chip firms with stable revenue, profits and cashflow.

Using the S&P 500 as a proxy and based on previous rate-cutting cycles, utilities, consumer staples, and healthcare tend to outperform on a 3-month basis after the initial cut.

Read more: How to evaluate and analyse Reits

Home loan rates

Similarly, some mortgage rates offered by banks here have been declining in anticipation of the change in monetary policy. It is timely to do a cost-benefit analysis and consider refinancing your home loan to enjoy some savings.

Fixed-rate home loans – which have interest rates that remain unchanged during a lock-in period – now average around 2.6 per cent. This is down from around 3 per cent at the start of this year.

Looking ahead, the outlook for such fixed rate home loans will also depend on market competition. Homeowners are advised to do their due diligence and consider their affordability and life goals before taking on a home loan.

Read more: 8 ways to make your home loan more affordable

Diversification and long-term approach is key

Historically, most assets tend to perform well when the Fed cuts rates. But rather than chasing the next best opportunity, focus on staying invested in the markets via a diversified portfolio.

For most people, relying mainly on low-risk products like T-bills will not be sufficient to mitigate inflation and achieve financial freedom. This is where understanding market risks and investing for the long-term via compounding come in.

For retirement planning, it is advisable to cast a longer investment horizon. More should be allocated into higher growth/risk assets to build your bases, allowing assets to work harder for you.

When investing for the long-term (an investment time horizon of at least 10 years), leverage a diversified investment portfolio that has some exposure to equities, which have historically generated higher returns in the long run.

Align your investments to your risk profile, financial goals, and time horizon. And do your due diligence before deciding which asset allocation is optimal for you.

To set up a diversified core portfolio for the long-term, you may consider adopting the Barbell Strategy which is advocated by DBS Chief Investment Office. A portfolio that follows this approach has an overweight exposure in growth equities such as those that ride on long-term, irreversible growth trends. The other end of the portfolio has an overweight exposure to income assets such as high-quality government and corporate bonds, along with dividend-yielding equities and Reits.

Staying invested and thinking long-term is the way to go.

Read more: Diversify to help manage investment risks