By Gwendoline Tan

![]()

If you’ve only got a minute:

- Fractional share trading allows investors to buy or sell fractions of a share instead of a whole share.

- It makes investing in the US market more affordable, enables diversification, and supports the implementation of various investment strategies.

- Fractional shares typically have lower liquidity, may not always be cost-effective, and can be harder to track in your portfolio.

- Trading fractional shares with the DBS Vickers Young Investor portfolio offers zero commission and platform fees.

![]()

Investing in the stock market used to be largely confined to those who could afford to buy full shares of a company, with stocks traditionally traded in whole units or lots.

For example, investors who buy shares listed on the Singapore Exchange (SGX) will be familiar with having to trade in lots, where 1 lot is 100 shares. This was not the case some years ago when 1 lot was 1,000 shares for most counters in Singapore. Since 19 January 2015, the SGX has reduced the standard board lot size of securities from 1,000 to 100 units.

More recently in 2022, the board lot size of SGX-listed exchange-traded funds (ETFs) was reduced to 1 unit, from the previous 5 to 100 units. These changes make higher-priced equity investments more accessible to retail investors.

In the US, you can buy as little as 1 share per trade.

While this may not sound like much, some stocks like those of tech giants or well-established companies can be extremely costly. The world’s most expensive share is that of Berkshire Hathaway (Class A), an American multinational conglomerate holding company, trading at a whopping US$708,902 per share as at time of writing. While Class B shares were issued in 1996 as a response to market demand for a lower-priced slice of the Berkshire pie, these are still trading at more than US$450 per share today.

Though the example of Berkshire Hathaway is an extreme end of the spectrum, investing in companies like Tesla, or META Platforms Inc, which owns Facebook, to name a few, would still require a minimum outlay of a few hundred USD per share. This can still be a high barrier to entry for many investors, especially those just starting out or with smaller portfolios.

The rise of fractional share trading aligns with the broader movement to democratise wealth and make investments more affordable. With it, you can now buy a “fraction” of a single share, opening up more opportunities to invest in companies without needing significant capital. This makes investing more accessible to a wider range of people, including young investors like first-jobbers or even tertiary students who would like to invest their savings.

Here, we’ll explore how fractional share trading works, its benefits, the potential risks involved, and how it can help in your investment journey.

Read more: I’m ready to invest, how can I start?

How can this work for you?

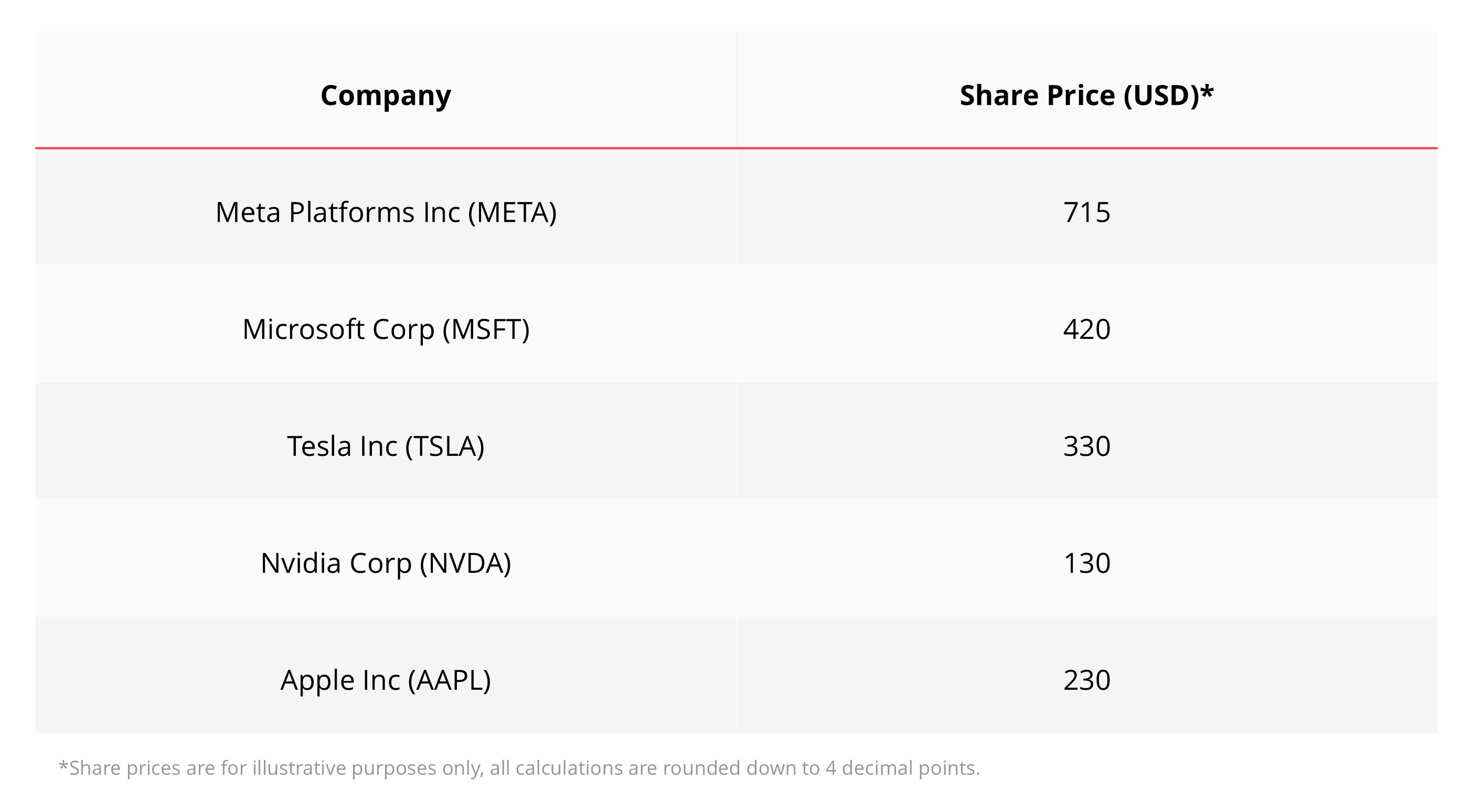

Imagine you have set aside US$500 each month for investing, and you are keen on buying the following stocks. There are several ways that fractional share trading can benefit you.

Scenario 1: You want to buy shares in META

Traditionally, this would not be possible as US$500 is not enough to buy 1 META share.

With fractional trading, this is no longer an issue. You can choose to buy US$500 worth of META, which will equate to 0.6993 shares (US$500/US$715).

Scenario 2: You want to buy MSFT and TSLA

Without the option of fractional trading, after buying 1 MSFT share at US$420, you will only have US$80 left which is insufficient funds to buy 1 TSLA share.

Using fractional trading, you can choose how to allocate your funds. Whether you prefer to allocate it equally with US$250 in each counter, or in another ratio of your preference, the choice is all yours.

Scenario 3: You want to invest the full US$500 into NVDA

Traditionally, you would only be able to buy 3 shares of NVDA which would total US$390. This would leave you with US$110 to be invested elsewhere or set aside.

In this case, fractional trading allows you to use the full US$500 to purchase 3.8461 shares of NVDA. This way you can use the full amount you have set aside to invest.

Scenario 4: You want some diversification by investing in more companies

Since fractional share trading allows you to allocate your funds according to dollar value, you can split your funds across several companies. If the purchase price does not result in a whole number of shares, you will get a fractional amount.

Here’s an example of how you can spread your funds across 5 different companies.

Read more: Diversify to help manage investment risks

As shown above, fractional trading provides access to high-quality stocks even with a smaller pool of investible funds. It offers greater flexibility in building a diversified portfolio, allowing you to spread your funds across different companies and/or sectors with smaller amounts of capital.

It may also be easier to implement various investment strategies, like dollar-cost averaging (DCA) and the core-satellite approach.

Dollar-cost averaging (DCA)

DCA involves investing fixed amounts at regular intervals into the same investment, helping to reduce the impact of market fluctuations over time. Since fractional trading lets you invest a specific dollar amount, it enables a more consistent DCA strategy, even with limited funds.

Read more: What to know about dollar-cost averaging

Core-satellite approach

The core-satellite approach seeks to achieve market average returns with a stable “core” of long-term investments, while capturing above-average returns with a tactical “satellite” component.

Fractional trading complements this approach by allowing you to allocate a smaller percentage of your total portfolio to equities that capitalise on trending themes, potentially outperforming the broader market.

Read more: What is a core-satellite portfolio?

What do you need to look out for?

Although more brokers are offering fractional share trading nowadays, not all do. If the platform you choose offers it, check that it includes the stocks or ETFs you want to trade.

When transferring shares between platforms, the process is usually done in whole numbers. Therefore, if you need to move your fractional shares, you may have to buy or sell the same counter to the nearest whole share before doing it. This extra step can create some inconvenience.

Additionally, fractional share trading may not always be cost-effective, depending on the fee structure of your brokerage. For example, if your broker charges a flat rate for each trade (e.g. US$1) and you are making a small USD$10 investment, that fee will represent 10% of your investment amount. This can significantly reduce your potential returns, especially if you’re making frequent small investments. Be sure to do your research to understand compare fee structures between platforms before deciding to trade.

If you hold many fractional positions, it can be difficult to keep track of your overall portfolio accurately. Moreover, for dividend paying stocks, you’ll typically receive only a fraction of the dividend payout based on your holdings, which could make dividend reinvestment less efficient.

As with any investment, it is crucial to understand the risks involved and ensure fractional share trading is aligned with your financial goals, risk tolerance, and time horizon. Especially when investing in foreign stocks, be aware that additional risk, like foreign exchange risk, could also impact your investments.

Read more: Investing in foreign stocks

Let’s do this!

Starting on your fractional share trading journey is simple. If you already have a DBS Vickers account, simply log in to your DBS Vickers mTrading App and begin.

Setting up an account

If you don’t have an account yet, it’s easy to get started. One application will set up both your DBS Vickers Online Trading Account and DBS Multi-Currency account (My Account or Multiplier). This can be done seamlessly on digibank online or the mobile app.

As fractional share trading is available for US equities, you must complete and submit the W-8BEN form and activate foreign markets trading. The W-8BEN form certifies your foreign status as a non-US citizen which allows you to claim tax treaty benefits, reducing US tax withholding on your income.

If you intend to invest in Singapore equities, you will also need to set up a Central Depository (CDP) Account.

US Fractional shares trading

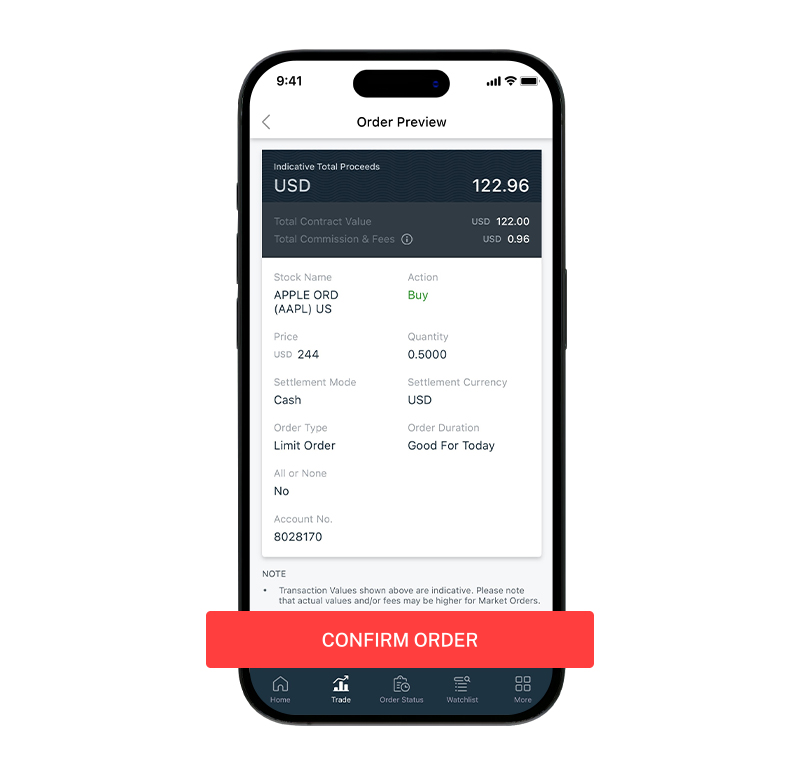

The process for placing a fractional share trade is largely similar to how you would place a regular equity trade.

1. Search for your stockEnter the stock you want to buy in the stock search field. Currently, DBS Vickers offers S&P 500 stocks and selected US ETFs for fractional trading.

2. Select your “Action”Choose whether you want to “Buy” or “Sell” your fractional shares.

3. Choose order type: “Quantity” or “Value”For quantity-based fractional orders, the minimum is 0.0001 share (up to 4 decimal places).

For order inputs by dollar value, the minimum is US$5 for buy orders, with no minimum for sell orders. The estimated quantity in this case will be calculated by dividing the dollar value by the price and rounding down to the nearest 4 decimal places.

4. Set your priceThis is applicable if you are placing a “limit” order, which is an order to buy or sell a stock at a specific price or better. If the stock does not reach the desired price, the order will not be executed.

5. Input your order valueSpecify either a dollar value or the fractional amount of shares you want to buy.

Once you have filled in these details, click on the “Preview Order” button to proceed to the “Order Preview” page where you can review your transaction details. This will show you the total contract value, commission fees (if any), and indicative total amount, before you confirm your order.

Enjoy zero platform fees and competitive commission rates

If you are between 18 and 25 years old, the Young Investor Account is for you!

Enjoy zero commission and platform fees on fractional share trades for quantities under 1 share. This means you can invest in US stocks and ETFs without the worry of added costs, making it easier for you to get started without needing large amounts of capital.

For trades above 1 share, there is a flat rate commission of US$6.54, with no platform fees, ensuring that your investments remain cost-effective.

For Individual Account holders (above 25 years old), there are no platform fees. Commission fees for trades under 1 share are US$0.96 per trade. For trades above 1 share, a percentage fee of 0.15% or more, depending on the settlement mode chosen, applies.

Read more: Using DBS Vickers and digibank for stock research

Find out more about: US fractional shares trading with DBS Vickers

Start your journey today

As the proverb goes, “good things come in small packages”.

Fractional shares make investing more accessible than ever, making it a great option for all investors, whether you are a beginner, have limited capital, or are a seasoned trader.

However, as with any investment strategy, it's important to understand both the benefits and potential limitations of fractional shares. By carefully weighing these factors, you can make more informed decisions that align with your financial goals.

Set up your accounts today and use the DBS Vickers app to trade anytime, from anywhere.