By Navin Sregantan

![]()

If you’ve only got a minute:

- Exchange-traded funds and unit trusts allow you to build diversity in your investment portfolio with relative ease to capture the broad-based performance of a particular market.

- If you find stock picking too tedious, using a combination of ETFs and unit trusts is another way to construct a comprehensive investment portfolio.

- Your investment portfolio should be tailored to your risk tolerance and financial goals, striking a balance between growth and security to ensure you meet your future needs with confidence.

![]()

Building a successful investment portfolio can feel overwhelming for the average investor. Thorough research into individual companies and sectors is required, alongside careful consideration of your risk tolerance and ever-shifting economic conditions.

However, a simpler approach exists for those wishing to participate in the markets by building their own portfolio: Investing with exchange-traded funds (ETFs) and unit trusts.

We'll explore how these pooled investment products simplify the process of building a well-diversified portfolio, making it easier for individuals who prefer a convenient and more accessible way to invest.

Why funds?

With ETFs and unit trusts, your money is combined with that of other investors to buy a diversified basket of assets, essentially giving you exposure to a wide range of investments, simplifying diversification and reducing risk.

These funds are popular among retail investors due to the diversification it affords, potentially lower transaction costs, and the reduced need for extensive stock research which is time-consuming for an individual to replicate.

1. Diversification across markets and sectors

ETFs and unit trusts offer diversification for investors. Many ETFs, for instance, track major indices like the S&P 500 or Straits Times Index (STI), providing exposure to numerous companies and mitigating the risk of investing in individual stocks. This also reduces volatility by spreading your investment across a wide range of assets.

ETFs specialising in specific sectors (like technology or finance) or segments of larger markets are also available. For instance, investors seeking growth in the technology sector can gain exposure through a global technology ETF, rather than selecting individual companies.

Unit trusts offer diversification, but through actively managed strategies overseen by professional fund managers. This professional expertise is particularly valuable for investors who lack the time or experience to manage their investments effectively.

Read more: How to start investing in ETFs

Find out more about: DBS Invest-Saver

2. Less time consuming

Investing in individual stocks and bonds requires significant time and effort dedicated to research. Before investing, you need to analyse a company's financial statements, understand its industry position, and assess its future prospects, among others.

The extensive research required is a significant time commitment and often demands specialised financial knowledge, which can be demanding for retail investors with full-time jobs and other responsibilities.

ETFs and unit trusts significantly reduce the need for individual stock research. ETFs track established market indices, while unit trusts rely on professional fund managers for asset selection and management. This allows investors to access diversified portfolios with minimal individual company analysis.

While ETFs and unit trusts simplify investing, it's still a good idea to do your due diligence and learn about what you're investing in. This is because it'll make you a more confident investor in the long run.

Read more: A beginner’s guide to unit trusts

Find out more about: Unit Trusts Investment With DBS

3. Potentially lower transaction costs

Buying and selling individual stocks incurs brokerage fees per transaction, and building a diversified portfolio requires purchasing multiple stocks and bonds, leading to potentially higher cumulative brokerage fees, especially for frequent traders. In contrast, ETFs and unit trusts typically have a single brokerage fee per purchase, regardless of the number of underlying assets.

While ETFs and unit trusts have annual expense ratios (management fees), these are often lower than the cumulative brokerage fees from frequent individual stock trading, particularly for smaller portfolios.

Furthermore, ETFs and unit trusts are inherently diversified which reduces the need for frequent trading to maintain a target asset allocation, further minimising transaction costs.

4. Liquidity

ETFs, traded on stock exchanges, are very liquid, allowing quick buying and selling. This characteristic is particularly valuable during market fluctuations, allowing investors to react quickly to changing conditions or capitalise on short-term opportunities.

Unit trusts, while not as liquid as ETFs, can still be easily redeemed, with many providers offering fast processing times. Reputable providers typically process redemption requests within a few business days, ensuring relatively quick access to invested capital.

At the end of the day, both ETFs and unit trusts offer a reasonable level of liquidity, although investors should be aware of the nuances between the two.

Creating an appropriate mix for your portfolio

Crafting the right investment mix is crucial for achieving your financial goals. Your portfolio should reflect your risk tolerance and future needs, balancing growth potential with peace of mind and ensuring you meet future capital requirements while feeling secure.

In general, younger investors, with their longer time horizons, are often able and willing to accept higher risk, while older investors tend toward lower-risk strategies.

That said, it isn’t always the case as increased longevity and the desire to avoid outliving one's savings may lead some older investors to allocate a portion of their funds to higher-risk investments with potentially greater returns.

Likewise, some younger investors might not have the risk tolerance to invest extensive in equities.

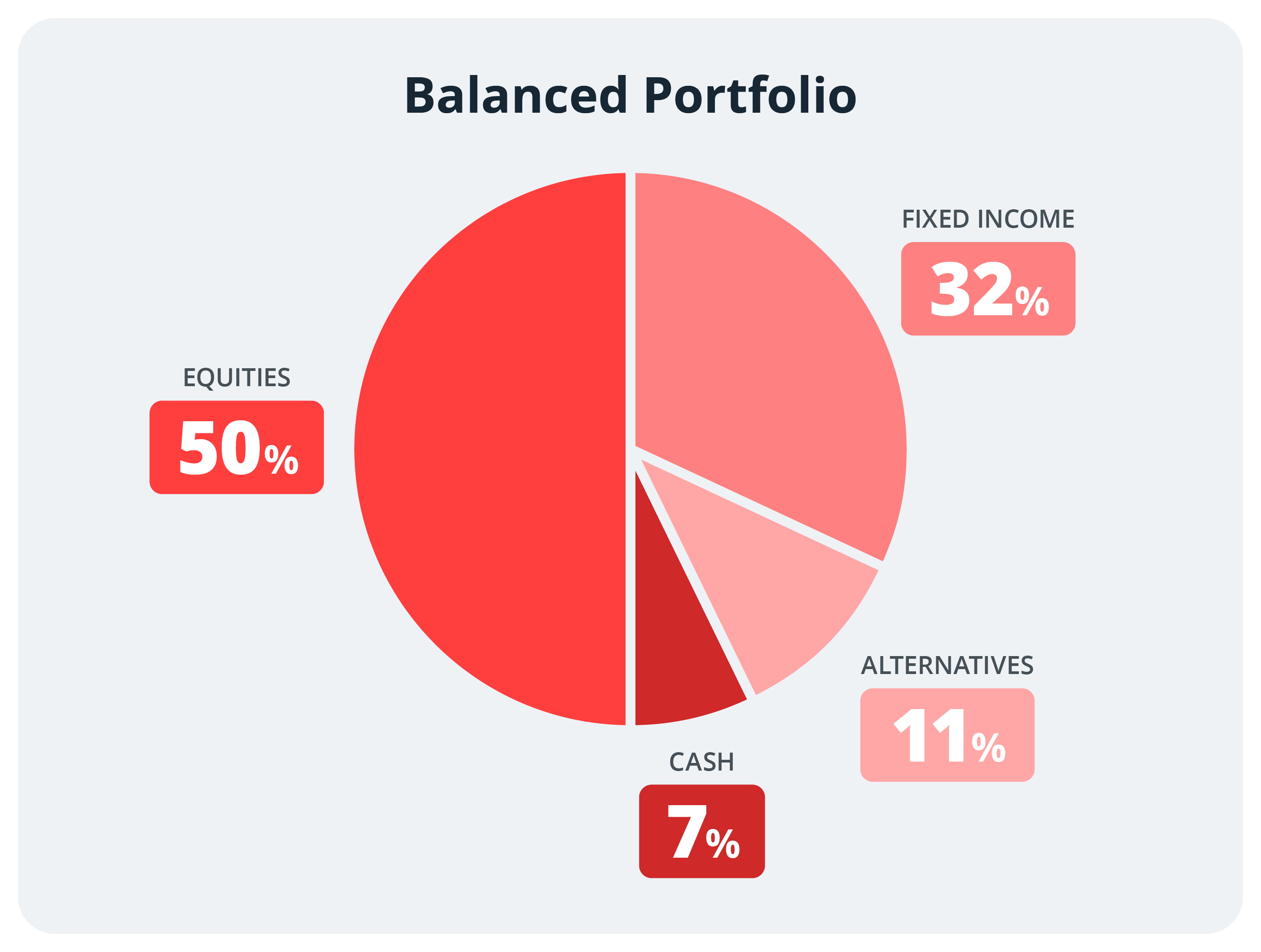

Below is an example asset allocation for a medium-risk, or balanced portfolio, which tends to be suitable for investors seeking modest capital growth through a balanced risk-return approach. This represents a middle ground for those building an investment portfolio.

For such portfolios, funds can be purchased in accordance with the proportions of money allocated to each asset class. Cash is often set aside for further investments and time-senitive/tactical opportunties.

Putting your strategy in play

Given that ETFs open your opportunities to conveniently holding various financial instruments, you can select ETFs according to the index and sectors to meet your desired asset allocation targets.

We illustrate the example of John and Jane’s portfolios, who are both investors with funds of S$10,000 available for investment.

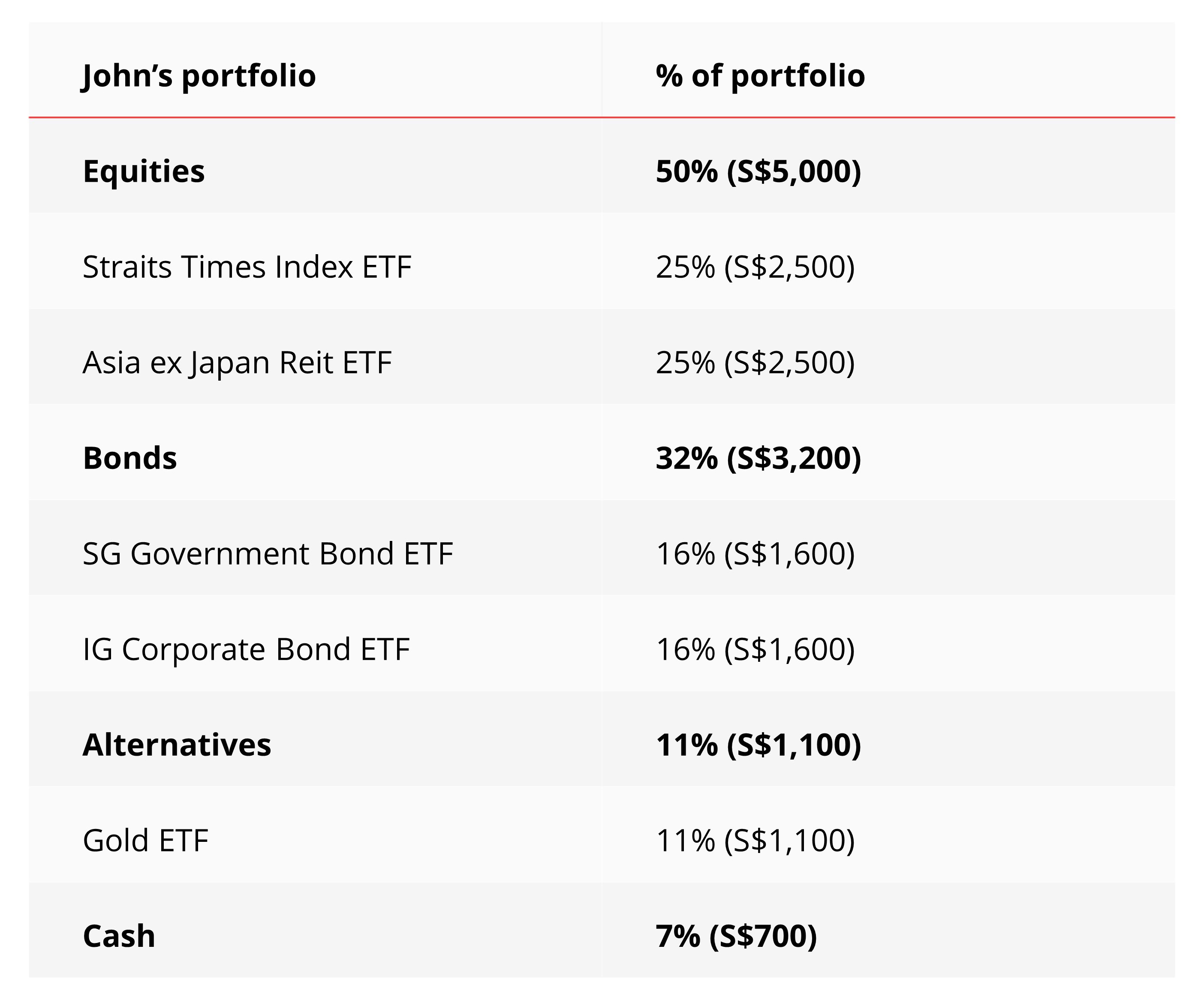

John’s Investment Portfolio

John is a first-time investor who has S$10,000 available for investment but has little understanding of global markets. He is more familiar with Singapore-listed companies and real estate investment trusts (Reits).

Adopting a balanced asset allocation to portfolio construction, John has chosen to invest his funds entirely in Singapore-focused ETFs and unit trusts.

*The above table illustrates two examples of what investors can do with to build an investment portfolio. This should not be relied on as investment advice. Investors should do their own due diligence.

However, this concentration of investments in a single country introduces concentration risk — the risk of significant losses if the Singapore market underperforms.

Singapore's developed economy does offer a degree of stability, but over-reliance on a single market carries inherent risks. In other words, while seemingly low risk, this approach is not without its drawbacks.

What should John do over time?

While starting with Singapore-focused investments is a sensible approach for a novice investor, John should consider gradually diversifying geographically as his understanding of global markets increases to mitigate concentration risk.

Furthermore, limiting investments solely to Singapore might restrict to potentially higher growth opportunities available in other, more dynamic markets like the US and Greater China.

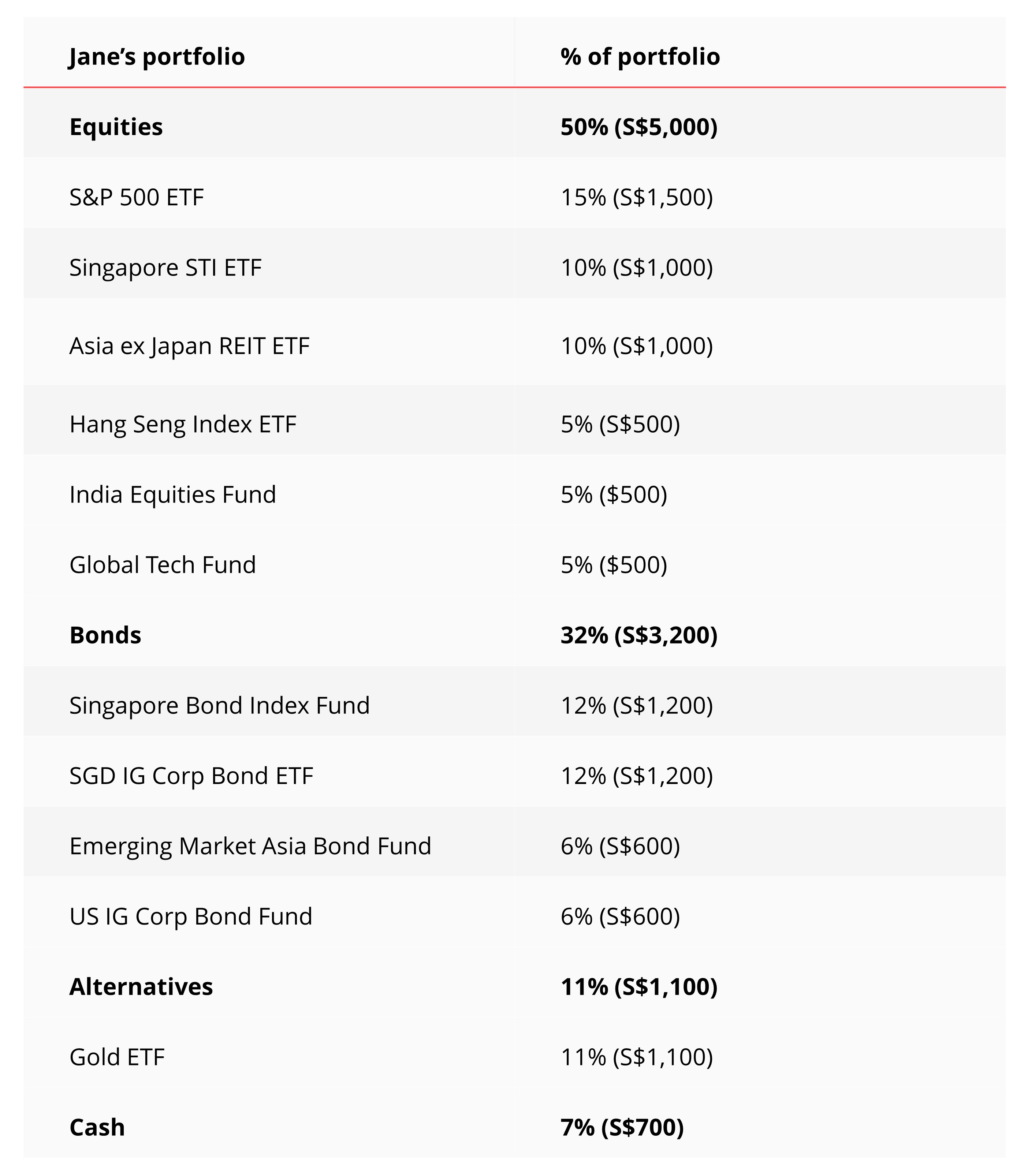

Jane’s Investment Portfolio

Jane, a first-time investor, diligently saved S$10,000 from her first job and is now ready to invest.

Like John, Jane has adopted a balanced approach to portfolio construction, but unlike him, her undergraduate studies provided her with a relatively stronger understanding of global financial markets and as such, her portfolio is already globally diversified.

*The above table illustrates an example of what investors can do with to build an investment portfolio. This should not be relied on as investment advice. Investors should do their own due diligence.

This diversification helps mitigate concentration risk by spreading investments across different countries and asset classes, reducing the impact of any single market’s and sector's underperformance.

What should Jane do over time?

Jane can continue building her portfolio by implementing a dollar-cost averaging strategy, which involves investing a fixed amount at regular intervals (e.g. monthly), regardless of market fluctuations. She can maintain her desired portfolio split by allocating each periodic investment according to her target asset allocation.

Jane should also regularly review her asset allocation to ensure it aligns with her risk tolerance and investment goals. This involves selling some assets that have outperformed and buying assets that have underperformed, bringing the portfolio back to its target allocation.

Read more: digiPortfolio - A digital portfolio for all

Find out more about: digiPortfolio on digibank

What if you prefer a more “hands-off” approach?

The sheer number of ETFs and unit trusts tracking similar indices (e.g., the SP 500) or employing similar investment strategies (e.g., technology-focused) can overwhelm novice investors, leading to choice paralysis and difficulty selecting suitable options.

The challenge lies in discerning the subtle differences between seemingly identical options, such as expense ratios, tracking error, and management fees, which can significantly impact long-term returns.

If you prefer a more “hands-off” approach to investing, there are a number of options to consider including robo-advisors. This is a catch-all term for investment managers and software that use algorithms to administer your investment portfolios.

With digiPortfolio, investors can benefit from DBS’ elite team of portfolio managers, whose expertise was previously accessible to only those with investable funds of S$500,000 and above.

Besides carefully selecting investments to create quality portfolios, the team of portfolio managers monitors the market regularly, aligning digiPortfolio with DBS Chief Investment Office’s views to ensure optimal asset allocation and portfolio resilience, and initiating rebalancing whenever necessary.

With digiPortfolio, certain processes like back-testing, rebalancing and monitoring are automated.

Whether you’re looking for low-cost investments, income generation, retirement planning, wealth preservation or simply want to grow your wealth for the long-term, there’s a portfolio for investment needs.

In summary

While pooled investment products such as ETFs and unit trusts offer numerous benefits for retail investors, it's crucial to remember that there is still market risk (the potential for losses due to overall market downturns) and the risk of underperformance relative to the benchmark or other investment options. Careful planning and due diligence are essential before investing.

For those seeking a more hands-off approach, robo-advisory services provide a viable alternative. Remember, building a diversified portfolio doesn't require immediate, large-scale purchases.

A phased approach, focusing on attractively valued assets and strategically timing purchases over 3 to 6 months for long-term investors, can be a highly effective strategy.