By Navin Sregantan

![]()

If you’ve only got a minute:

- Exchange rate movements can have a significant impact on investment portfolio returns.

- A currency’s strength is often an indicator of improving economic conditions and increasing exports, among others.

- In FX trading, currency pairs are broken down into major pairs, minor pairs, and exotic pairs.

![]()

When it comes to foreign currencies, we tend to think of its (more) practical applications like when we’re on holiday or when we make online purchases, but its uses far extend beyond these.

Other common applications include parents sending funds to their children studying overseas and remittance of salaries by foreigners working in Singapore.

For those diversifying by holding foreign stocks and bonds, fluctuating exchange rates - the value of one unit of a currency relative to the value of another currency - can breed uncertainty and have a significant impact on the value of investment portfolios.

With local stocks, it is easier to track investment performance as they are often purchased and denominated in the Singapore Dollar (SGD). This is less straightforward with foreign investments as they are often bought and denominated in their local currencies (e.g. US Dollar, Japanese Yen).

Naturally, all investors who hold foreign stocks face currency risk - the possibility that the value of your investment is eroded due to unfavourable changes in exchange rates.

By understanding exchange rate movements and its impact on your portfolio, you can take pre-emptive measures to protect your hard-earned savings and spot investment opportunities.

Read More: What can I do with my foreign currency?

What makes currencies move?

The foreign exchange (FX) market is open 24 hours a day from Monday to Friday, which means the value of currencies and by extension, exchanges rates are always fluctuating.

While short-term fluctuations could affect a currency’s strength overnight, paying attention to medium- and long-term drivers of currency movements is more crucial.

In other words, focus more on the trend between 2 currencies to better understand its impact on your investment portfolio.

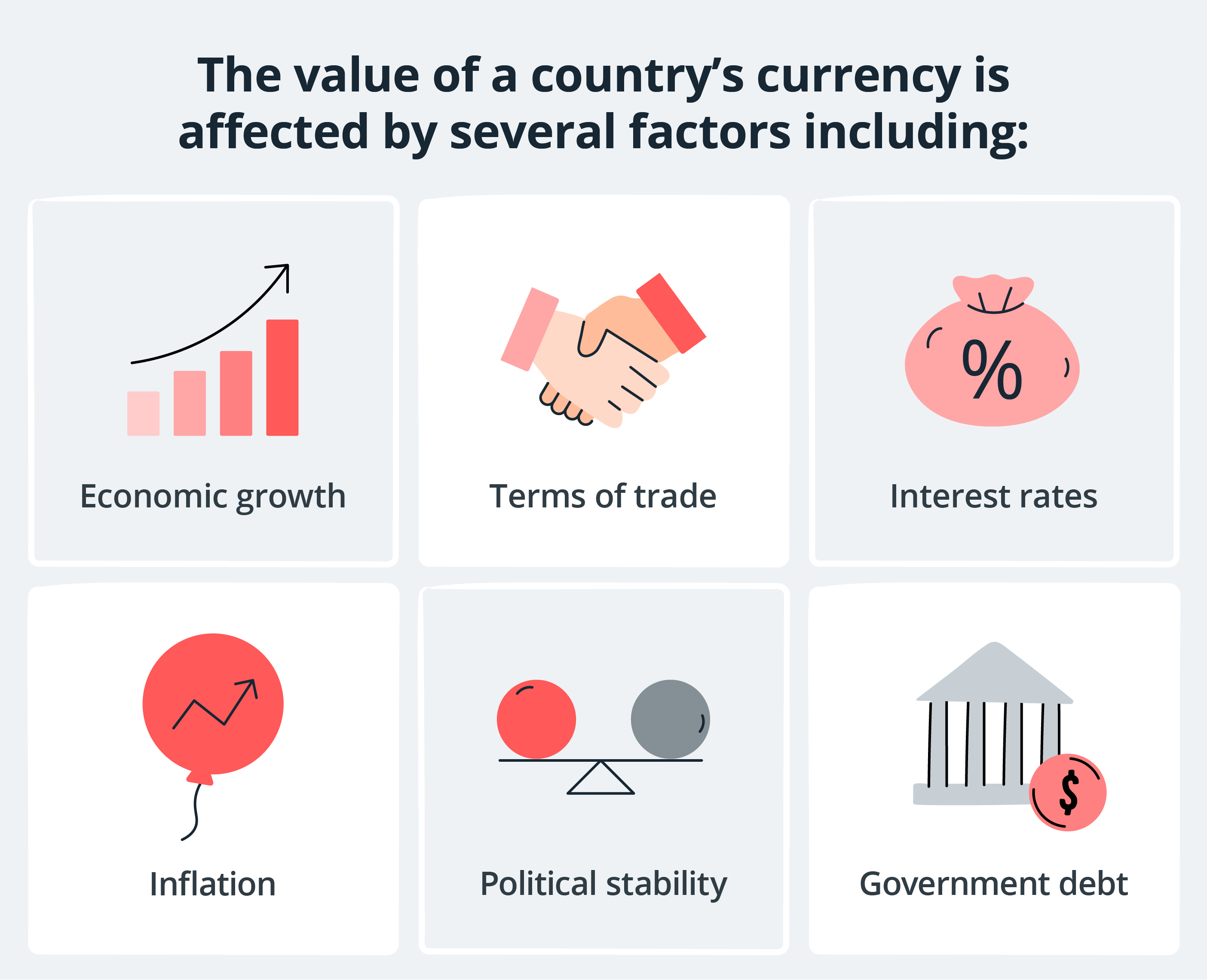

Meanwhile, a currency’s relative strength is often an indicator of improving economic conditions and health.

When more people are confident in a country’s prospects and quality of products, they are more likely to buy assets denominated in that currency, resulting in increased demand for the currency for international trade. This, in turn, can push its price higher in relation to other currencies.

Another factor that can affect the strength of one currency against another is terms of trade - the ratio of the cost of a country’s imports to the price of its exports. In general, countries that export more than they import from trading partners will typically have stronger currencies.

In the case of Australia, an economy that relies on the export of commodities like coal and iron ore, the Australian Dollar (AUD) appreciated against the Chinese Yuan (CNY) during the period of large-scale purchases of Australian commodities by China in the early 2010s. During this period of high demand for commodities, the AUD and US Dollar (USD) were close to parity too.

A country’s currency also becomes more appealing when interest rates look like they could increase, because it carries the promise of higher yields on assets.

Some investors choose to exchange currencies based on higher fixed deposit interest rates offered. This is one of the reasons that contributed to the strength of the USD in 2023 and 2024 and consequently the uptake in foreign currency fixed deposit placements.

On the other hand, political instability and higher government debt are more likely to have an opposite effect on the value of a currency. This was reflected in the drop in the British Pound (GBP) relative to other major currencies during the Brexit period.

As these factors are likely to develop over time, you should pay more attention to currency market trends instead of overnight movements.

Read More: The basics of foreign exchange

Building a diversified FX portfolio

As experienced investors can attest, one of the benefits of diversification is the ability to improve and stabilise your potential returns, especially over the long-term.

By owning a wider range of investments with different characteristics, you can reduce overall risk by not having a single investment affect your returns too much.

The case for building a diversified FX portfolio is largely the same. Holding foreign currencies can shield your investment portfolio from unexpected FX risks by offsetting a loss in one currency against another.

An FX portfolio is a selection of currency pairs that are held with the purpose of achieving investment goals through capital preservation and risk mitigation. Much of what foreign currencies to use is dependent on the currency denomination of the equities, fixed income, and bonds that you own.

Analysing currencies

To analyse currencies, you can use a combination of fundamental and technical analysis, similar to the techniques that are used to analyse individual stocks and other investments.

Fundamental analysis focuses on related economic and financial factors which range from macroeconomic indicators to news events, along with other factors that can affect the value of a currency.

Meanwhile, technical analysis involves studying historical data, charts, and patterns to predict future price movements.

By combining these approaches, you can gain a better understanding of the market and the price trends between 2 currencies.

Read More: Fundamental vs technical analysis

Regular monitoring

Just like you would with your stock portfolio, monitor the performance of your FX portfolio regularly. It is helpful to keep a log of your trades along with the reasons for making them.

Regularly assessing your portfolio's performance is essential for making necessary adjustments and improving your trading approach.

Common currency pairs

In FX trading, currency pairs are often broken down into major pairs and cross currency pairs.

Major pairs

Currency pairs that have the USD – the strongest and most prominent currency globally – are known as major currency pairs.

Given that the greenback dictates how the FX market moves, major pairs are often among the most traded or active currency pairs. This results in them having the highest liquidity.

If you are just starting to build your FX portfolio, then the major pairs might be the best place to start as they would be more liquid.

Cross currency pairs

Cross currency pairs, also referred to as “crosses”, do not have the USD in either the quote or base currency.

Given its generic definition, the range of cross currency pairs is wide, and also includes currencies of emerging markets. Emerging market currencies are less prevalent, and hence are often considered riskier than the major pairs and the common crosses.

While many of these pairs are still traded globally, crosses tend to be less liquid as compared to the major pairs, with emerging market currency crosses even more so.

In summary

Exchange rate movements do impact investment portfolio returns, which is why a better understanding of them can help you can take pre-emptive measures to protect your investment gains against FX losses.

For those looking to invest (or already are investing) in FX, remember to do your due diligence in researching on the currencies you are looking to invest into.

When building your diversified FX portfolio, do remember to use a combination of technical and fundamental analysis to make your decisions.