Mandatory Documents Required for the Following Applications:

- Credit Card and Cashline Credit Limit Review

- Income Update for Credit Cards and Unsecured Loans Application

- Reinstatement of Suspended Accounts

Singapore Citizens and Permanent Residents

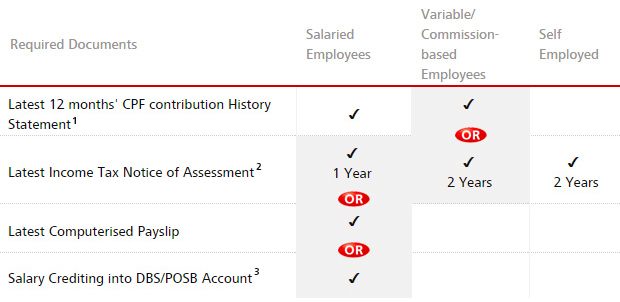

1 Please note that your CPF documents submitted online with SingPass is only available for up to 7 days from the date of your submission.

2 You can now print your Income Tax Income Notice of Assessment at myTax Portal with your Singpass or IRAS Pin. The service is free. Log on to https://mytax.iras.gov.sg for more details.

3 Your salary must be credited via GIRO, to your own DBS/POSB Account for the last 3 consecutive months and your current annual income meets our minimum income criteria. Salary credited into joint account will not be considered.

Foreigners (Not applicable to Cashline Credit Limit Review)

Mandatory Documents Required for Supplementary Credit Card Application

We require you (the Principal Cardholder) to upload your Supplementary Card Applicant's documents indicated below for us to process the application:

| Supplementary Card Applicants who are Singapore Citizens and Permanent Residents | Supplementary Card Applicants who are Foreigners |

|---|---|

| NRIC (front and back) | Valid Passport; and Proof* of residential address (e.g. utility/telephone bill or bank statement) *Must be valid within 3 months from date of submission. |