- Lump-sum Contribution

- One-time contribution with ad-hoc funds (e.g. an inheritance or bonus)

- Additional contributions as and when funds are available

- Start from just S$1,000 for certain funds

View the user guide for step-by-step instructions to using Funds on digibank

Chat with our friendly Wealth Planning Managers now. (This chat service is available from 9am to 6pm on Mon to Fri, excluding Public Holidays.)

- DBS Invest-Saver (UTs)

- Fuss-free monthly contribution from your DBS/ POSB via interbank GIRO or monthly deductions from your DBS/POSB savings or current account on the 15th of every month.

- Start investing from just S$100/month

- With Dollar-cost Averaging, you can potentially enjoy a lower average cost over time, compared to lump-sum contributions

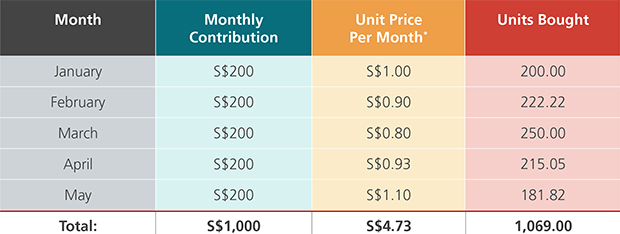

Illustration: How does Dollar Cost Averaging work?

Average cost per unit: S$1,000 / 1,069.09 units = S$0.935

Average price per unit: S$4.73 / 5 months = S$0.946

The example above shows how Dollar Cost Averaging in Invest-Saver (UTs) can result in a lower cost per unit and lower average price per unit. With the same total contribution of S$1,000, Invest-Saver (UTs) allows you buy more units (total of 1,069.00 units) at a lower average unit price of S$0.935 over five months as compared with lump-sum contribution (total of 1000.00 units bought at a unit price of S$1.00 in January).

All Invest-Saver (UTs) monthly contribution will fall on the 15th of every month (or the next business day if the 15th is a non-business day). Please note that the respective debiting date is subject to change.

Check out our list of RSP eligible funds.

View the user guide for step-by-step instructions to using Funds on digibank

- Both Lump-sum Contribution and Invest-Saver (UTs)

- Make a lump sum contribution (e.g. with your bonus) but continue investing with regular monthly contributions

- Start investing with a lump sum of S$1,000 for certain funds and continue with monthly contributions of at least S$100/month

Three ways of funding your Unit Trusts investment

- Cash

- CPF Ordinary Account or Special Account savings

- SRS holdings

There will be an online sales charge of 0.82% per transaction on any investment amount.

Effective 1 Oct 2020, if you are using CPFIS funds for purchase of investment products, 0% up-front sales charge will be imposed, and you may ignore any sales charge stated.

Find out how much you should invest now, to reach your investment goal here.