Driving Asia’s Infrastructure Transformation and Economic Recovery with Private Capital

At the recent 2021 Asia Infrastructure Forum event, DBS Managing Director and Head of Project Finance Subash Narayanan called for more private funds flowing into infrastructure projects to drive sustainability in infrastructure to the next level. Here are the highlights from the panel.

Climate change and the pandemic have accelerated the demand for renewable energies and sustainable infrastructure to aid the economy and fulfil new investor interests in ESG-compliant assets.

In her keynote address, Singapore’s Second Minister for Finance and Second Minister for National Development Indranee Rajah shared, “Asian governments and multilateral development banks have identified infrastructure as an important means of achieving economic recovery through increased access to financial flows and boosting construction activity and employment. To that end, some governments are proactively accelerating their infrastructure development.”

India, for example, increased their budget allocation for infrastructure development by 34.5% this year. At the same time, the Philippines has added 13 new infrastructure projects covering digital connectivity, water supply, transportation, and healthcare to their priority list.

However, bridging the infrastructure gap in Asia has met with certain roadblocks, especially in financing.

Governments can’t close the funding gap alone—private capital firms need to step up

Relying solely on government funding to bolster infrastructure is not feasible. The pandemic has caused an unprecedented strain on government funds, with fiscal policies tightening to focus on staving off economic recession and maintaining public health and safety.

“While many governments have already taken steps to drive economic recovery through infrastructure development, additional investments through public-private partnerships (PPP) would be a welcome source of liquidity as countries continue to devote urgent resources to battle the pandemic,” she added.

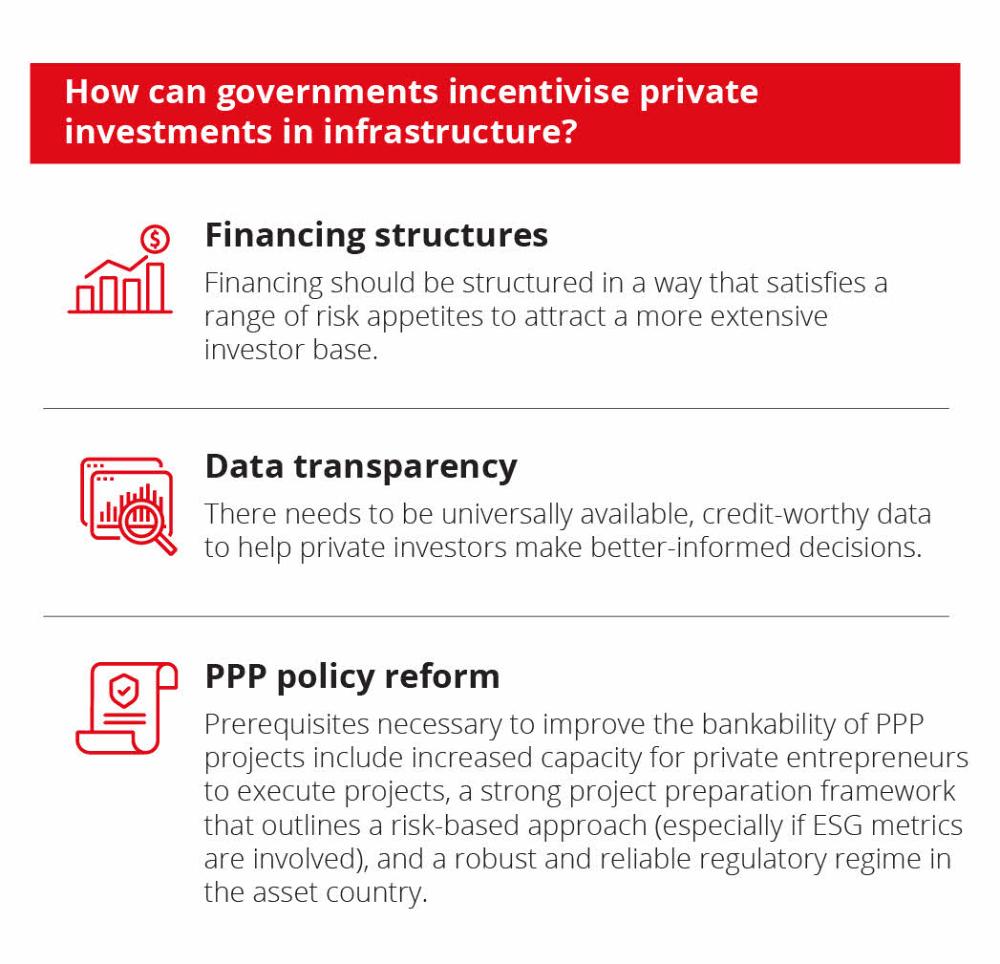

Funding for infrastructure has traditionally come from government funds and commercial banks. However, opening up to alternative sources, such as insurers, pension funds, and endowment funds, can give infrastructure financing the required boost.

According to Guggenheim Investments, an estimated USD 70 trillion worth of global private capital could potentially be made available for infrastructure projects. Unfortunately, as Subash observed, only very little of it has been activated. “In Asia, per ADB forecasts, USD 1.7 trillion investment is required with 40% from the private sector. But if you look at some of the league table reports on funding raised from the private sector, only USD ~240 billion is from private investments,” he shared. “That is short of expectations, so my wish is to see a lot more of private funds flowing into infrastructure projects.”

Private capital can help advance Asia’s sustainable infrastructure agenda

Attracting private investors presents another set of challenges. In particular, the lack of balanced risk mitigation and the absence of an agreed-upon international standard for what constitutes “green” financing are holding private investors back from committing their funds to infrastructure projects.

Fintech can generate investor momentum for sustainable infrastructure in Asia

Technological innovation plays a prominent role in improving the operational aspects of infrastructure. Better data analytics to reduce energy consumption and waste, carbon scrubbing technologies to offset emissions, and more advanced utility-scale batteries to improve renewable energy storage are only a few examples. And the future holds even greater potential, with technologies like the Internet of Things, 5G, artificial intelligence, robotics and more to be harnessed to create sustainable infrastructure that’s reliable, power-efficient and cost-effective.

Technology can help with financing solutions as well. Specifically, financial technology (fintech) can provide the accessibility, transparency and accountability required to build private investor trust in infrastructure projects. One example of this in action is the proposed Climate Impact X (CIX) marketplace, which use blockchain to facilitate the trading of high-quality carbon credits for carbon offsetting purposes.

“The critical thing for carbon credits is often customer integrity. How do you ensure that the credit being sold is backed, and how do you verify that? That’s why we turned to blockchain technology to ensure that the platform is set up in a cost-efficient manner while allowing for verification of the credits being traded,” shared Subash. “I can see a similar platform being used to facilitate infrastructure finance, to raise capital and equity for listed projects.”

Stepping forward into a more sustainable Asia

In recent years, DBS has helped finance landmark projects such as Sembcorp’s floating solar project in Tengeh Reservoir, Singapore, and multiple floating solar and offshore wind projects in Taiwan and Vietnam. With a noticeable and growing appetite from private investors to enter the infrastructure and renewables sectors, there is hope for more private funding to pour into Asia’s infrastructure—as long as financing terms remain attractive and developers are held accountable to ESG goals.

Read more Business Insights on project financing and sustainability from our DBS team.