DBS Digital Readiness Survey

regional report for Small-to-Medium Enterprises

Asia Pacific businesses can reach greater heights with stronger digital strategies

DBS Digital Readiness Survey

regional report for Small-to-Medium Enterprises

Asia Pacific businesses can reach greater heights with stronger digital strategies

Digital Readiness Survey 2021: Highlights for SMEs

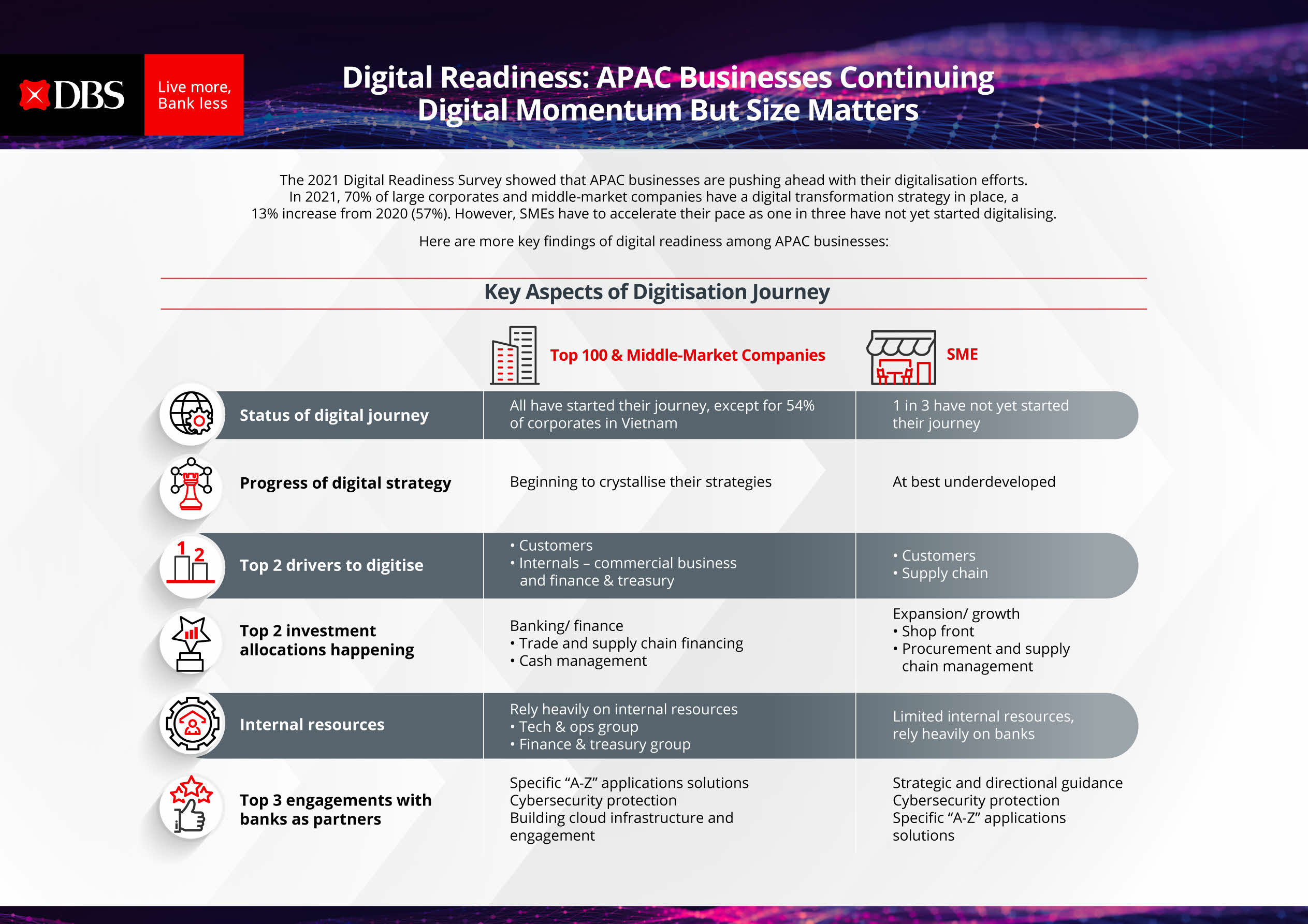

The third edition of the DBS Digital Readiness Survey includes, for the first time, data on SMEs’ digital readiness, charting progress in digitalisation across all business functions. With SMEs making up 96% of all Asian businesses, the success of SMEs will in turn propel the growth of Asia’s economy for the digital decade to come.

SMEs in APAC are making good headway in digital transformation with two in three SMEs (64%) having already started their digital journey. While SMEs are unhindered by legacy infrastructure or stale strategies, on the flip side, they are impeded by their scale. Results in the survey indicate that the smaller in size businesses are, the less likely they are to adopt new digital practices, as they have limited resources and lack competitiveness for digital talent.

However, the survey also highlights that SMEs are fast realising that digitalisation is no longer optional. Once regarded as simply a tool in gaining competitive advantage, digitalisation has now become a necessity for businesses to survive and a precondition to thrive in the ‘new normal’.

Transformation driven by external pressures

External pressures such as customer demand and growing supply chain complexities are key drivers in transformation, with 94% of SMEs experiencing external pressure to change. In comparison, competitive pressure, and internal stakeholder push play a less prominent factor in driving change. This signals a reactive, rather than proactive, stance to digitalisation.

Top challenges include technology and talent

Why does scale matter? Despite technology becoming more affordable with time, SMEs still cite the cost of technology adoption as their main challenge, with six in ten organisations struggling with this on the back of competing investment priorities. Another challenge SMEs face is access to talent. As technology skills increase in demand, SMEs find themselves competing with larger businesses – who have more resources to provide more attractive offers- for access to a limited digital talent pool.

Help comes from partners

As SMEs chart their digital paths, they are increasingly engaging the use of fintech services, with 84% relying on their banking partners to advise on the right technology-enabled solutions and services for their business. Concurrently, banks are also offering strategic and directional guidance to help SMEs start their digitalisation journey and accelerate their digital transition.

For more in-depth findings of corporate digital readiness in Asia Pacific, follow the links below to read the report:

SME: Country Reports

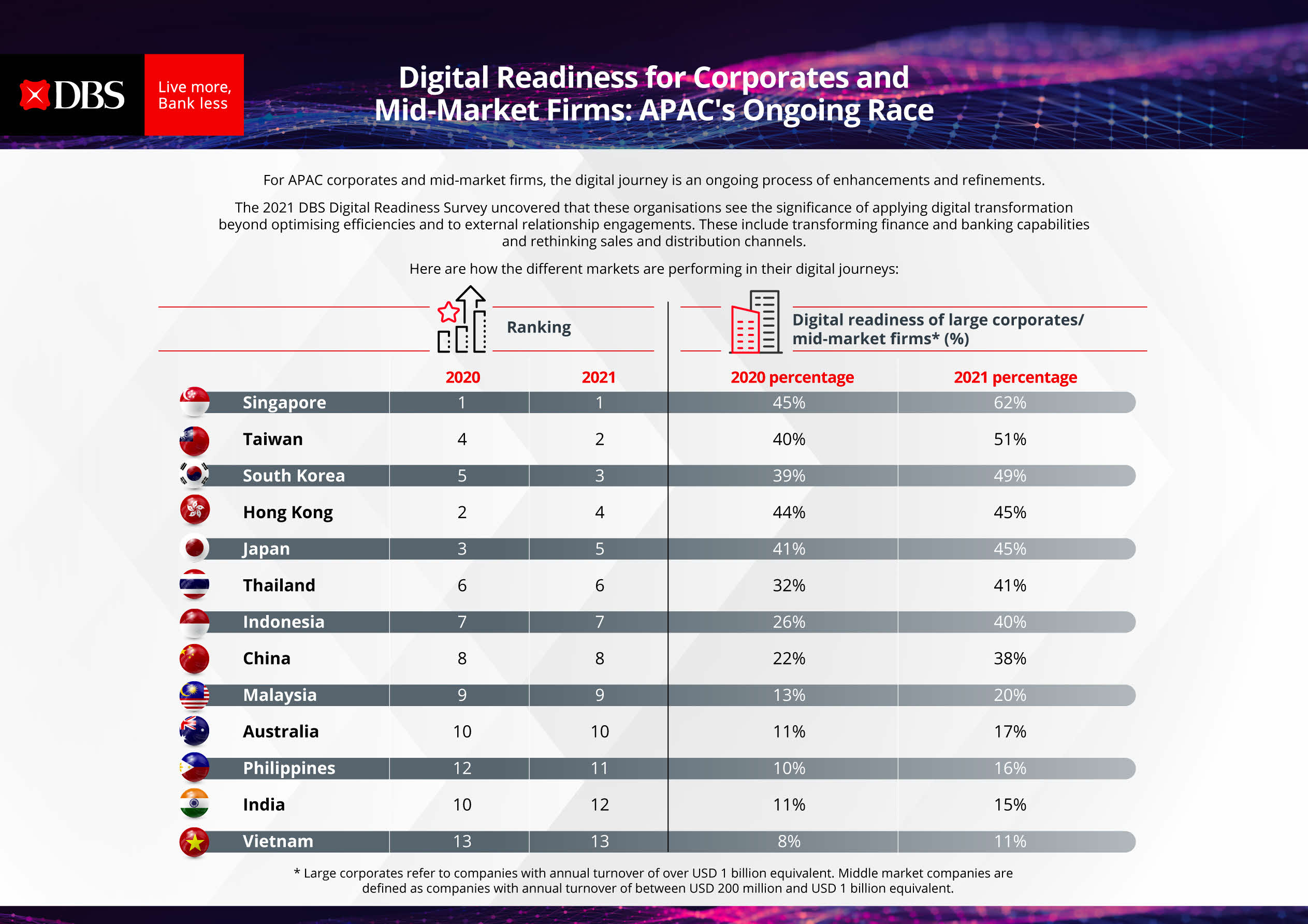

There are marked cross-market differences when it comes to digitalisation amongst SMEs in Asia Pacific. This market disparity is characterised by pacesetters in smaller countries like Singapore (91%) and Taiwan (74%) having started their digitalisation journey, while larger markets like Indonesia (56%), China (54%) and India (50%) are gaining momentum in their digitalisation efforts.

Find out more about SME digitalisation journeys, barriers to digital adoption, key investment priorities and more in the different countries across Asia Pacific.

Call

From overseas: +65 6222 2200

In Singapore: 1800 222 2200

Operating hours: 8.30am to 8.30pm, Mon - Fri (excluding PH)