Supporting the Metals & Mining sector’s push to net zero

The emerging ecosystem for EV batteries in Asia will be more and more important.

China’s recent emergence from its prolonged COVID lockdown and shift away from strict zero-COVID rules is having a positive impact on output and consumption in the country. In particular, the reopening of the economy is a positive sign for the metals and mining sector, which feeds into several other important industries such as infrastructure, shipping, aviation, steel and automotives, that are the pillars of the region’s economic growth.

This is coupled with strong growth in India, which is expected to be fastest growing major economy in the world in 2023. Together, the IMF expects1 China and India to contribute more than half of global growth. Indonesia, Asia’s fifth largest economy, is also expected to witness strong growth this year.

In China, the demand for metals is expected to increase further, given supportive policies related to the property sector and infrastructure—which are important contributors to GDP.

Separately, China’s manufacturing activity expanded at its fastest pace in more than a decade in February 2023, with its PMI touching 52.6.2 While this trend is expected to normalise soon, as the sudden jump is due to the country’s unexpected u-turn in its covid restrictions, increased manufacturing activity in China yield augurs well for the metals and mining sector in the region.

These and other topics were discussed at a roundtable discussion hosted by DBS Bank at the recently concluded3 BloombergNEF summit in Bali, Indonesia.

Market trends

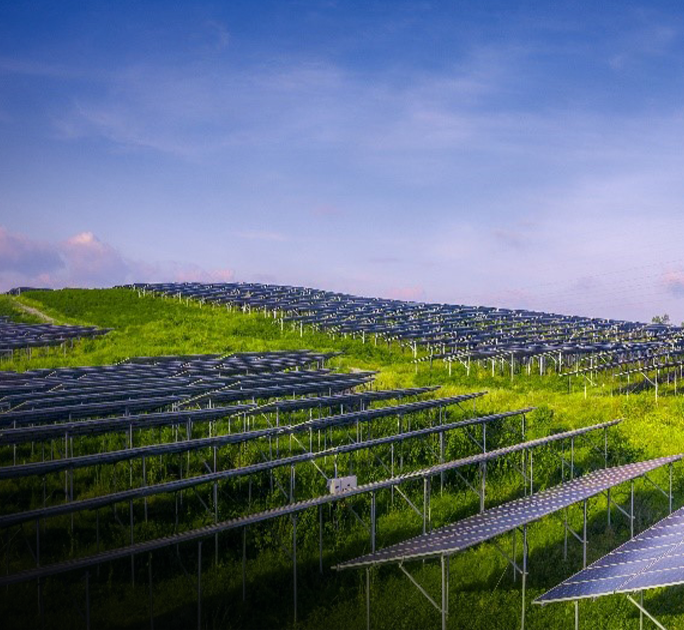

As incomes grow across Asia, there is increasing consumer awareness about the debilitating impacts of fossil fuels on the environment, and one of the key market trends having a direct bearing on the metals and mining sector is the drive towards sustainability and a low carbon future.

The region is expected to drive the next phase of growth in electric vehicles (EVs). Asia is expected to continue witnessing rapid growth in the demand for automobiles, and a growing share of these new vehicles will be EVs. This will help speed up the net zero transition in the region.

Metals and mining are going to be central to this transition. Often chastised for their negative impacts on the environment, companies in the sector have a central role in helping the automotive sector—one of the world’s largest greenhouse gas emitters—turn green.

The automotive sector is trying to successfully decarbonise, but a swift shift from fossil fuels to electricity is only possible with the use of batteries, the development of which depends heavily on non-ferrous metals such as nickel, lithium and cobalt.

Asia is poised to be a critical player in the global EV value chain, and this shift will be supported by the region’s metals and mining sector. Nickel, which is a key ingredient used in EV batteries, is found in abundance in Indonesia. The country will contribute greatly to global nickel output, expanding production from 125,000 tonnes in 2022 to 165,000 tonnes in 2023.4

The increasing demand to go green, coupled with rising incomes in the region, has resulted in a surge in the demand for electric vehicles—sales of EVs in Southeast Asia grew by 35% y-o-y in Q3 2022. Thailand captured the biggest share of EV sales at 60% of the market5, followed by Indonesia and Singapore.

Asia is by far the largest nickel market globally, consuming 82% of global nickel production.6 China, one of the biggest consumers of nickel, will further drive its demand, with several policies implemented to stimulate EV sales in 2023. Plug-in electric vehicle sales in China have already crossed 5.92 million units in 20227, 83% more than in 2021.

Large mining companies are, in many ways, leading the move to go green. For instance, Rio Tinto, one of the world’s largest mining conglomerates, is pioneering the use of autonomous trucks8, drones and robotic process automations to increase productivity while being environmentally-friendly. It is but one example of a company in the sector making use of technology to limit (or manage) its carbon footprint.

A green push

Achieving greater sustainability in the metals and mining sector itself is no easy task. The sector has a complex upstream and downstream supply chain, which makes it difficult to determine the sources of emissions. Complex and often underdeveloped regulations are another challenge, while costs remain a key concern too.

But progress is being made—most companies are aware of ESG considerations and are taking steps to limit emissions of greenhouse gases.

Given the growing focus on ESG in the region, the emerging ecosystem for EV batteries in Asia will be more and more important. The region is well placed—Southeast Asia has the resources; China is meanwhile developing a leading position in precursors; while South Korea, Japan and China are developing leading competencies in battery manufacturing. Indonesia’s approach to go downstream will also enhance Asia’s position.

In all of this, the metals and mining sector, therefore, is expected play a key role in Asia emerging as an important player in the EV battery segment.

DBS Bank is playing its part. It is the only bank in the region to have set up net zero commitments along entire industry segments. It has set across S$50 billion in financing its sustainable targets, with plans to zero thermal coal commitment by 2023. The bank has been working with its metals and mining clients along the value chain to create long term value for its stakeholders in a sustainable and scalable way, including through green loans, bonds and exploring sustainable supply chain solutions. It is also engaging with clients to help them decarbonise operations through how it lends, playing a key role in the transition to net zero in the region.

- https://www.imf.org/en/Blogs/Articles/2023/02/20/asias-easing-economic-headwinds-make-way-for-stronger-recovery

- https://www.reuters.com/markets/asia/china-feb-manufacturing-activity-expands-fastest-since-april-2012-official-pmi-2023-03-01/

- https://about.bnef.com/summit/bali/

- https://www.spglobal.com/marketintelligence/en/news-insights/research/nickel-cbs-january-2023-price-falls-on-tsingshans-new-supply-plans

- https://www.counterpointresearch.com/sea-ev-sales-q3-2022/

- https://insg.org/index.php/about-nickel/production-usage/

- https://insideevs.com/news/651363/china-plugin-car-sales-december2022/

- https://www.riotinto.com/en/about/innovation/automation