Indonesia Energy Sector’s pathway to decarbonisation

What are the alternate pathways to decarbonisation for fossil fuel players? Do green investments create value? A look at some case studies in Indonesia.

Net-zero is considered the benchmark standard for decarbonisation, and most companies in the region aim for net-zero by 2050 or so, depending on national policies, with interim goals in 2025 and 2030. But what does it mean to reach net-zero? Does it mean stopping existing mining or drilling activities? No, net-zero means balancing the amount of emissions or greenhouse gases produced with the amount that’s removed from the atmosphere.

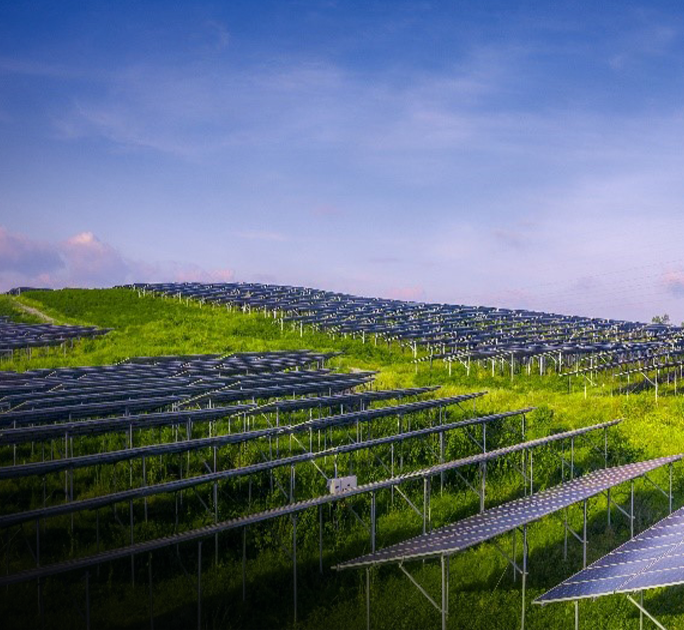

Legacy fossil fuel players must therefore maintain their profitable cash flows from existing business and channel a part of those cash flows to counter the effects of emissions. Investing in green energy assets is one part of the solution, but we believe there are three pathways to decarbonisation and diversification that can be employed: 1) investments in clean energy and electrification, 2) investments in new-age materials that will power battery and storage, and 3) investments in circular economy and energy efficiencies.

These pathways allow fossil fuel companies that have benefited from the latest commodities boom to shift their capital incrementally away from fossil-related energy business and deploy in a way that adds value to all stakeholders. How do companies choose the best way forward? We believe each player will have to forge a unique way forward, depending on their geographical presence, existing skillsets and complementarity of business segments. Keeping this in mind, we would like to highlight the journeys of some fossil fuel companies on the path to decarbonisation.

Given our deep knowledge of the energy ecosystem in Indonesia, we have chosen to highlight and study Indonesia-listed energy companies in this regard and observed that diversification initiatives have generally had a positive impact on valuations, which shows that there is value to investing in decarbonisation initiatives. This is testament to the importance of improving ESG standards and creating a sustainable business model which ensures continued access to financing, lowers material risks from non-compliance, ensures prudent capital allocation and delivers balanced growth.

Take the case of lesser known coal miner Harum Energy for example. Its thermal coal reserves are among the lowest compared with other listed players in Indonesia. However, the successful transition to nickel mining to support the EV value chain has allow the company to churn profits and achieve better valuation uplift than much bigger listed players. This has spurred peers into action as well. Adaro Energy, for example, has made moves into the green aluminium smelter space – potentially powered by hydropower – to benefit from the rising aluminium demand from EV car makers in China. There has been rising interest in initiatives in other parts of the energy value chain as well. Of course, “greenwashing” is something we would be careful about, but so far, it seems there is life for legacy fossil fuel companies beyond fossil fuels, and it is all about choosing where to spend that cash wisely.