Global Race for EV Battery Capacity Heats Up

China remains major player as OEMs rapidly scale up battery manufacturing, driven by EV demand, gov't policies.

Global race to expand EV battery capacity heats up, but China remains a major player

A major shift is underway in global Electric Vehicles (EV) supply chains, as Original Equipment Manufacturers (OEMs) rapidly scale up EV battery manufacturing to become major players in the global industry.

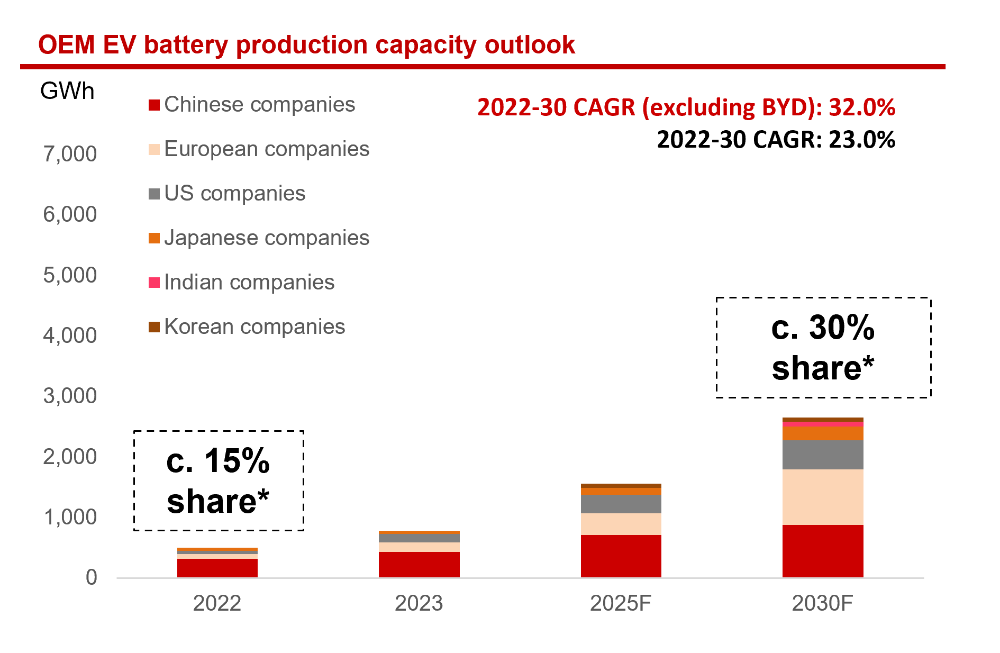

OEMs1 are expected to capture up to 40 percent share of total worldwide EV battery capacity2 by 2030, with new OEM battery capacity coming from both in-house and Joint Venture (JV) investments, according to DBS Bank estimates.

Chinese OEMs will continue to play a major role in EV battery capacity, making up one-third of OEM EV battery capacity and almost 15 percent of total worldwide EV battery capacity, predicts DBS Group’s “Global Automakers’ Battery Strategy” report. BYD makes up about 75% of Chinese OEM EV battery capacity.

Chinese OEM companies, including BYD, Zhejiang Geely, Guangzhou Automobile Group (GAC) and more, are expected to expand their EV battery manufacturing by 14 percent CAGR by 2030, though there could be some fluctuations in the near-term from a potential moderation in EV demand.

Meanwhile, western OEMs in the fast-electrifying markets like North America and Europe are catching up. They are expected to scale up their EV battery manufacturing capacity at a relatively faster pace at 30 to 40 percent CAGR from its current low base by 2030, boosted by new US and European Union government incentives.

That said, Chinese OEMs will still remain a major player to OEM battery capacity and to total worldwide EV battery capacity, with China positioned to have the most comprehensive and competitive EV value chain today.

Strong drivers

DBS’ report examines the global race to build more battery hubs, which is driven by the long term trend towards rising EV demand as well as supportive government policies to boost capacity.

While we are seeing short term moderation in the pace of growth of EV demand due to affordability concerns, lower subsidies and charging infrastructure/technology issues, we believe the long term trend remains intact as we see more affordable model being rolled out by OEMs, alongside improving charging infrastructure, declining battery costs, improving technology and access to materials.

At the same time, attractive government policies and the push for more resilient, sustainable local supply chains are also spurring automakers to invest more in battery production, as well as vertical integration from cell assembly to raw material recovery.

All these will support an estimated 25 percent CAGR expansion in OEM battery capacity for global OEMs by 2030, DBS predicts.

China continues to play a major role

In APAC, OEM battery manufacturing capacity is forecasted to expand from the current 400 GWh to approximately 1,100 GWh by 2030. This translates into CAGR growth of 14 percent. The region will continue to be dominated by Chinese players, who will own up to 80 percent of its APAC OEM EV battery capacity by 2030.

Chinese players are deploying various approaches to expanding their EV battery capacity: some opt for in-house battery investments; others are setting joint venture investments, and certain Chinese OEMs are choosing to do both.

Automaker GAC is strengthening its control over the EV supply chain by self-developing EV batteries. Meanwhile, BYD is not only scaling up their own battery business units to supply EV batteries to other automakers, but also expanding overseas to reach more global OEMs.

On the other hand, Dongfeng and Geely have chosen to go down the joint venture route, collaborating with battery companies to co-develop EV batteries.

Faster growth in the US and Europe

European and US are expected to expand their electric battery capacity by up to 40 percent CAGR between 2022 and 2030, double the growth rate of the APAC market.

This fast growth is expected to be driven by state EV tax credits incentives under the US Inflation Reduction Act (IRA) and the European Union Critical Raw Minerals Act (CRMA). Such policies aim to encourage OEMs to localise their EV value chains, amid rising concerns by these countries about their reliance on selected countries such as China and Russia for battery raw materials and parts.

In response to these incentives, global OEMs from General Motors to Tesla and Ford are planning more battery manufacturing plants in North America and Europe. Asian OEMs such as Honda, Nissan, Toyota, and Hyundai are also joining in setting up manufacturing plants in North America and Europe.

Competition heats up

China is likely to continue to be the world’s largest market and producer for EVs over the next three decades. But western automakers aim to catch up, as the latter invests significantly to create more secure EV value chains by concurrently investing in EVs, battery cell, critical minerals, and other components.

American automakers have invested US$58 billion in EV supply chain to take advantage of tax credits since the IRA’s launch. This sets the stage for a more intense race between Chinese and western players to capture market share.

In terms of OEM battery capacity, Chinese and EU OEMs is expected to account for almost one-third each in 2030, and American OEMs at 18 percent. When aggregating total OEM battery capacity, OEMs are expected to contribute to 40% of total worldwide EV battery capacity, with Chinese and EU OEMs as major contributors at c.15% each, and US OEMs at 7%.

Oversupply concerns

In recent years, the industry has seen robust EV battery capacity expansion plans from both independent battery manufacturers and OEMs, which poses battery oversupply concerns. OEMs are becoming a major EV battery player, which may lead to headwinds to battery makers’ earnings and market share. Based on industry estimates, overcapacity over total rechargeable battery demand could amount up to 27% by 2030F.

This could result in downward pressures to battery plant utilisation rates, especially those owned by battery makers, as OEMs are likely to prioritise their own in-house/JV plants over independent suppliers. While battery oversupply is positive to OEMs’ gross margins, this could lead to pressures on independent battery players, and will be a key industry trend to watch going forward.

To find out more about the dynamics of the global EV battery race, check out DBS’s report here.

1. OEMs mentioned here includes Tesla, Ford, GM, Hyundai/Kia, Honda, Nissan, Subaru, Suzuki, Toyota, Mitsubishi, Tata Group/Jaguar, Volkswagen, BMW, Mercedes, Stellantis, Volvo, Renault Group, BYD, Dongfeng, GAC, GWM, SAIC, Zhejiang Geely and more.

2. Total worldwide EV battery capacity includes battery capacity from both OEMs and independent battery manufacturers.