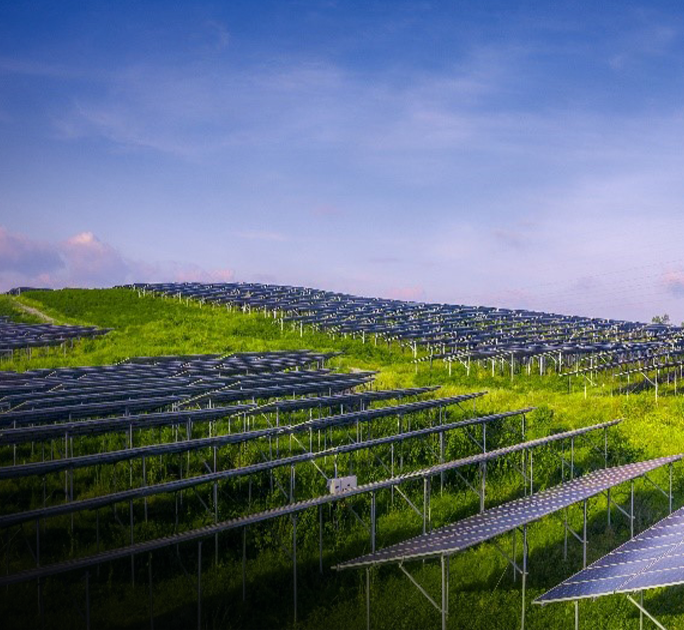

Boosting green initiatives in Indonesia Energy Sector

Has Indonesia reached an inflection point in its ambitious decarbonisation story? What opportunities do we see in the market?

At a recent G20 Summit last year in Bali, US President Joe Biden signed a US$20 billion climate finance bill, which will mobilise financing from the public and private sectors over the next few years to help Indonesia transition away from coal. Could this deal, which represents the largest single climate finance deal globally, be the tipping point that accelerates Indonesia's plan towards diversify its energy mix away from thermal coal?

Indonesia has a net-zero emission target by 2060, which looks ambitious on paper given its significant exposure to coal-fired power plants. But a joint study by the International Energy Agency (IEA) and Indonesia's Ministry of Energy and Mineral Resources (MEMR) suggests that the country can achieve this goal through the deployment of renewable energy resources, energy efficiency, electrification, and grid interconnection.

Indonesia now has a concrete decarbonisation plan under the new Electricity Business Plan (RUPTL) 2021-2030, aligned with Indonesia’s net zero emission plan by 2060. Under this plan, renewable energy will account for 21GW of the total power addition in 2030 with renewable energy mix target of 23% by 2025 and early retirement plan for coal fired power plants.

To aid this transformation, Indonesia has been focusing on unlocking the value of its natural resources by encouraging downstream and processing industries and opening new diversification opportunities for legacy energy companies. Indonesia ‘s ambition to become the Electric Vehicle (EV) battery cell plant hub was initiated in 2021. The plan is set to capture the global transition to EV cars, as well as Indonesia’s strategy to add value of its mineral ore reserves. One of the major downstream processing opportunities lies on the potential development of EV and related critical components, in particular the battery value chain.

Nickel for Electric Vehicle (EV) is one of the big opportunities in this space. Indonesia holds 24% of global nickel reserves and is set to leverage the potential by creating the battery supply chain. Indonesia’s first battery cell plant is under construction and more will be in the pipeline, creating demand for smelters and processing plants in tandem. Indonesia’s nickel supply chain will also require cleaner energy to ensure a greener footprint and such a trend would deliberately accelerate coal-fired power plant retirement.

The EV value chain hub and net zero emission initiative opens up additional investment opportunities as the chain reactions from this plan will transform many aspects of the Indonesian economy, creating supporting infrastructure needs such as industrial parks and ports and logistics hubs. Furthermore, there is an opportunity for carbon capture and storage from existing coal fired power plants as part of the net zero emission plan.

Not only does this open up opportunities for domestic corporates, overseas investors interested in Indonesia's lucrative EV ecosystem and decarbonisation theme could also consider looking at how Indonesia’s legacy fossil fuel players are transforming their business models and even consider joint investments to participate in the country's accelerating decarbonisation efforts.