Forging a Sustainable Path Forward

Steel overcapacity, emissions woes spur urgent transition need to sustainable production future, says Mike Zhang, Managing Director, Global Head of Metals and Mining at DBS.

The steel industry stands at a pivotal crossroads. While steel remains the foundational backbone propelling global development, its outsized environmental toll can no longer be ignored. The sector accounts for a staggering 7% of total global greenhouse gas emissions - more than the entire nation of India. With the growing urgency of climate action, steelmakers face intense pressure to decarbonize operations and transition towards sustainable production. Failure to adapt could see the industry's long-term viability and competitiveness grind to a halt under the weight of tightening regulations and shifting market demands. This existential turning point requires courageous leadership, large-scale investment in green innovation, and a fundamental re-envisioning of how the world produces this indispensable material.

Over the last several years, the world has seen a gradual decline in steel production. According to the World Steel Association, global crude steel production fell 5.3% year-on-year as of December 2023.1 Even so, the crisis of global steel overcapacity remains with production levels rising despite sluggish steel demand across major markets around the world. According to the Organisation for Economic Co-operation and Development (OCED), global steel capacity utilisation has declined for two consecutive years.2 In 2023, the gap between global steel capacity and production is expected to widen further to 610 million tonnes on an annualised basis, intensifying the challenges to markets and capacity management.3

There are also significant impacts on the climate: as traditional steel-production is a highly carbon-intensive process, an overcapacity of steel production has increased the industry’s overall emissions. New steel production accounts for roughly 8% of total energy systems emissions, or 2.8 gigatonnes of CO2 emissions per year.4 Based on these calculations, reducing even a third of the world’s excess steel capacity could cut out as much as 2% to 14% of emissions and make steelmakers healthier.5

The environmental and climate concerns for steel are no longer fringe issues, particularly as developed markets increasingly impose “green trade barriers” on steelmakers, notably those in emerging markets such as China and India. These sanctions are hiking up exports costs for steelmakers amidst a declining market, resulting in shrunken price advantages and declining product competitiveness.

The result is a steel industry facing a multi-front battle where it must navigate the challenges posed by declining demand for steel and greater pressure from stakeholders to perform better on their emissions for the sake of the climate. From our perspective, the steel industry is now entering a state of deep adjustment as it works to transition their operations towards more sustainable and financially viable framework.

Carbon-intensive steel production technologies remain dominant in Asia

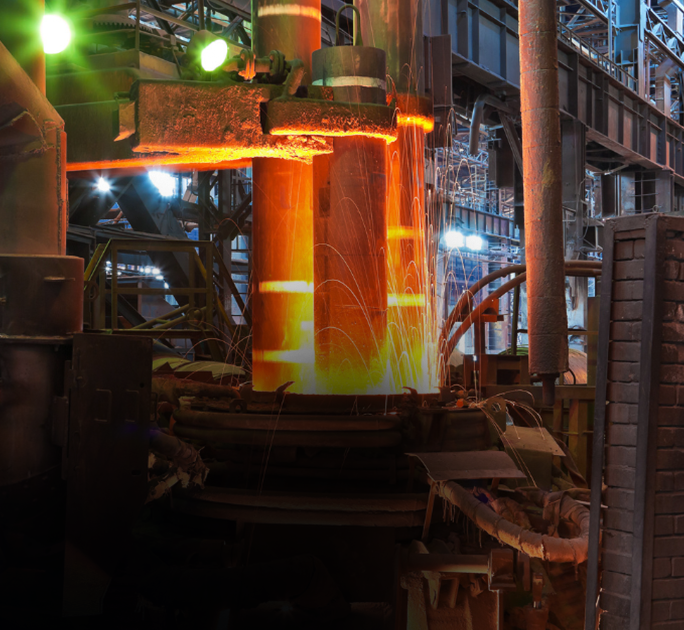

AS the foundation of global industrialisation, steel has carved out a role as one of the largest emitters of CO2 in the world, accounting for about 7% of global CO2 emissions.6 The reasons for this lie in the technological underpinnings of global steel production: blast furnace-converter (BF-BOF) steelmaking and electric arc furnace (EAF) steelmaking.

The main difference between these methods lie in their raw materials use, but BF-BOF processes are 75% more carbon-intensive than EAF steel.7 Despite so, BF-BOF is the dominant method in Asia – where 90% of the world’s steel is made – compared to the EAF method which accounts for only 29% of global steel production.8

Additionally, many governments in Asia lag the developed markets in terms of policies and regulations to promote cleaner methods. This, coupled with a structural shortage of scrap supply across Asia and a lack of transparency in the current pricing mechanism, has hindered the shift from BF-BOF steelmaking to EAF steelmaking.

These numbers help emphasise the monumental effort needed to decarbonise this high carbon intensive industry, a critical step towards realising global net-zero ambitions. Electrification will be essential to this, but that will require fundamental changes in the way steel is produced, not to mention, transitions in power grids and energy generation sectors.

However, enabling that transition to more sustainable technologies and infrastructure will require a huge amount of capital expenditure, especially given the fact that existing assets in the steel industry have a long lifespan.

A fundamental change in the way steel is produced is needed

Steel emissions reduction forms a significant pillar of DBS’s sustainability targets.

DBS’s steel portfolio is heavily concentrated in Asia, where most steel capacity is new and is unlikely to be retired from the market anytime soon. Overall, this contributes to a slower-than-expected pace of decarbonisation in the steel sector, DBS is still focused on honouring our commitments to our stakeholders to achieve net-zero.

As part of DBS’s net-zero commitment, the company has made concerted efforts to decarbonise its portfolio. In our 2023 Sustainability report, we noted that DBS’s steel portfolio carbon intensity has marked degrees of improvement, falling from 1.99 kg of CO2/kg of steel produced in 2022 to 1.95 kg of CO2/kg of steel in 2023. This is only marginally higher than the standards set out in Mission Possible Partnership’s Technology Moratorium scenario, which sets a decarbonisation target for the steel industry at 1.83 kg of CO2/kg of steel.

Behind the success that we have achieved so far are our ongoing efforts to engage our steel industry clients and support their transition to more sustainable and less carbon-intensive production methods. The reality is that transitioning the steel industry to cleaner technologies and infrastructure will be extremely costly in the short-to-medium term, which is why our efforts to decarbonise our portfolio has been focused on extending key financing solutions to stakeholders across our value chain.

Where steelmakers are still using BF-BOF methods, we have directed financing towards the use of higher-quality iron ores and fuel mix optimisation. We have also helped steelmakers gradually shift to EAF by offering financing to obtain recycled scrap or explore green hydrogen-based direct reduced iron (DRI). DBS is also directing funding towards the development of alternative technologies for the industry, such as Carbon Capture, Utilisation and Storage (CCUS) that could mitigate the emissions occurring in the industry.

Positive impacts from financing emissions in Asia’s steel sector

In DBS’s experience, there are ways to incentivise better sustainability standards in Asia’s steelmakers through innovative financing solutions.

With a pure play Global Metals & Mining Industry team, DBS offers a full range of professional products and services that span the whole spectrum of the steelmaking process – from production, smelting and refining all the way to cross-chain trading activities.

Our experience and expertise uniquely position us to capture key opportunities in the metals and mining value chain and provide tailored solutions across multiple markets.

As climate change is a global issue, we recognise the importance of offering solutions that also cut across borders. In 2023, DBS’s focus on sustainable financing solutions like Transition and Green Loans have increasingly turned to steel mills in the region, especially key markets such as Taiwan and India.

We also continue to provide sustainable trading operations and structured digital solutions to our corporate clients in the steel industry to issue letters of credit to members of the International Council on Mining and Metals (ICMM).

We believe that these efforts will have a positive impact on our financed emissions in the steel industry over time, which will be gradually reflected in the future emissions data of our corporate customers.

DBS will continue to scale up sustainability-linked loans (SLLs) to help companies set specific emission reduction targets or covenants to reduce their carbon emissions figures, thereby incentivising corporate customers to achieve net zero. We will also continue to adjust our selection criteria to focus on clients with smaller carbon footprints and clearer roadmaps for decarbonisation.

In the next step, we are evaluating the adoption of a regional carbon reduction target reference scenario that aligns with our markets and portfolio of clients in a collective movement towards global decarbonisation.

1. https://worldsteel.org/zh-hans/media-centre/press-releases/2024/december-2023-crude-steel-production-and-2023-global-totals/

2. https://www.oecd.org/industry/ind/latest-developments-in-steelmaking-capacity-2024.pdf

3. Ibid.

4. https://www.iea.org/reports/emissions-measurement-and-data-collection-for-a-net-zero-steel-industry/executive-summary

5. https://www.oecd.org/industry/ind/latest-developments-in-steelmaking-capacity-2024.pdf

6. Mission Possible Partnership – Net-Zero Steel Sector Transition Strategy (2021)

7. https://steelnet.org/independent-study-validates-that-steelmaking-by-electric-arc-furnace-manufacturers-in-u-s-produces-75-lower-carbon-emissions/

8. World Steel Association