Story of the day

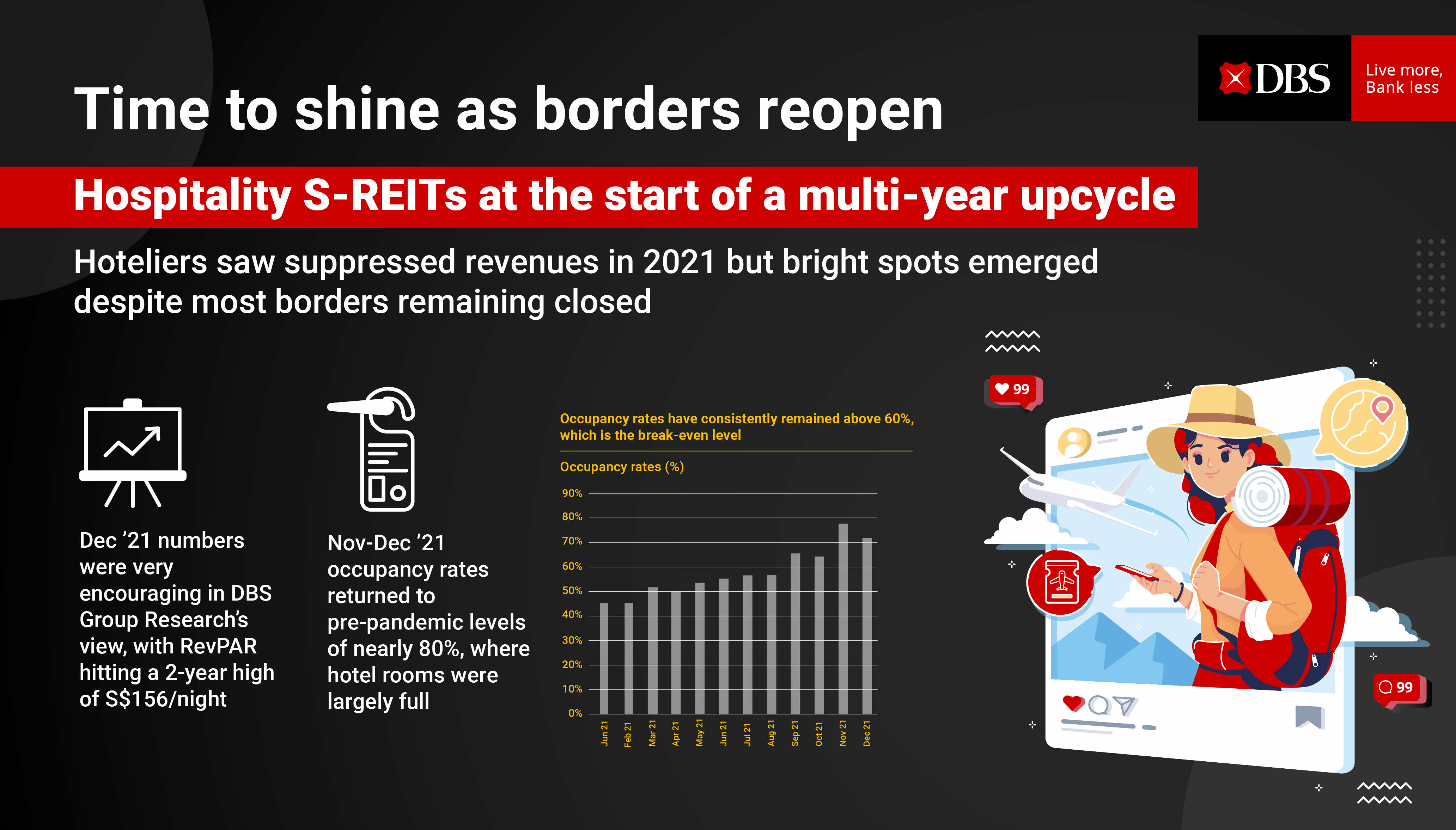

Hospitality S-REITs are at the start of a multi-year upcycle after seeing suppressed revenues in 2021, with bright spots emerging despite most borders remaining closed. International border relaxation will be the next catalyst as Singapore's relaxed entry requirments on quarantine and testing should bring a boost.