What is a core-satellite portfolio?

By Navin Sregantan

![]()

If you’ve only got a minute:

- Diversification reduces the likelihood that a single asset’s underperformance will drag down your overall portfolio performance.

- One of the most accessible ways to implement a core-satellite portfolio is to construct the “core” with a combination of index pooled investment funds.

- The “satellite” can be constructed with pooled investment funds or individual stocks that take advantage of trending themes and sectors that are likely outperform the broader market.

![]()

The Covid-19 pandemic, technological advances that have lowered barriers to entry and social-driven investment communities are some of the central drivers of the increased participation of retail investors in global financial markets.

According to US Federal Reserve data, direct stock ownership by American households grew from 15% to 21% from 2019 to 2022. Meanwhile, 1 in 4 equity trades were made by retail investors in 2021, almost twice as much as in 2011.

The same can be said in Singapore, where more now invest as a way grow their hard-earned savings for retirement and to achieve other long-term goals.

Greater retail investor participation is definitely a welcome sign but this also means more have a higher and wider exposure to market risks than before, especially if they are not diversified.

The importance of diversification

Diversification is all about ensuring that you are not putting “all your eggs in one basket”. By placing your capital in different investments, the likelihood of your investments being wiped out is reduced.

Even though investors are familiar with this concept, putting it into practice is easier said than done. For instance, it is common for investors to have a “home-country bias” due to a familiarity with local corporate names, the nature of their business, and the local economic conditions.

Another example is emulating others who have made huge returns by taking punts on a single stock without considering your own circumstances. Do not put all your money in one place, especially if it is in speculative investments, as you could risk it all (or most of it) at once.

All things considered, there is always an element of risk and the possibility of making losses when you invest. But one of the proven ways to mitigate such risks is to diversify both across and within asset classes by geographies, industries and by investment style.

With a well-diversified portfolio, an underperforming asset is less likely to be a drag on overall performance as it may be less correlated with other assets in the portfolio. In addition, you are likely to have consistent and predictable returns year-on-year instead of volatile ones.

Read more: Diversify to help manage investment risks

What is the core-satellite approach?

Employing a core-satellite approach is one of the most accessible ways to build a well-diversified investment portfolio.

The goal of the core-satellite approach is simple: Achieve market average returns with a stable “core” of long-term investments while aiming to capture above-average returns with the tactical “satellite” component.

To form the core, a retail investor uses passive investment instruments like exchange-traded funds (ETFs) that track equity indices (e.g. S&P 500 and Straits Times Index) and/or actively-managed unit trusts that cover broad themes (e.g. Global Technology, Investment Grade Bonds).

Meanwhile, the satellite is constructed with a combination of pooled investment funds and equities that take advantage of trending themes and sectors that are likely outperform the broader market in the short- to medium-term. The satellite component is the part of the portfolio that individual investors must actively manage.

Advantages

There are several advantages for taking the core-satellite approach. Using a combination of ETFs and unit trusts is a more hassle-free way for individuals to manage their investments. Moreover, by using such pooled investment funds, retail investors can also minimise trading costs and volatility.

Employing such a strategy also provides flexibility. As every investor has a different risk appetite, your core-satellite portfolio can be constructed with your individual goals, personal situation, preferences, and risk tolerance in mind.

Read more: Investing with only ETFs

Constructing a core-satellite portfolio

As you might expect, the “core” should form most of your investment portfolio. How much? Usually between 60% and 80% of your investible funds or capital.

Much of how much of your funds form the core of the portfolio ultimately depends on your risk tolerance as well as your financial planning aims and targets.

The Core

Using an 80/20 allocation – this is a very common split when taking the core-satellite approach, here is how an investor can construct the “core” with index ETFs and unit trusts.

*The above table illustrates two examples of what investors can do with to build an investment portfolio. This should not be relied on as investment advice. Investors should do their own due diligence.

It is key to seek out reliable and consistent returns from a broad range of sources for your core investments, which are long-term in nature.

In the example above, the core forms 80% of the portfolio and is made up of ETFs that track major indices (e.g. S&P 500 & the Straits Times Index) as well as globally diversified unit trusts like those that provide exposure to investment-grade bonds and Gold, among others.

The core portion of the portfolio can be used to whichever investment style that suits you. In other words, you can pick a value-focused core, or if you have a higher risk tolerance, a growth-focused one. Similarly, you can have a heavier focus on foreign stocks over local stocks.

The Satellite

Having strong core investments allows you to have the freedom and flexibility to invest in higher risk products that could give you better-than-normal market returns.

The 20% allocated to the satellite can be invested in long-term structural trends and themes. This can be done though individual stock picking or through ETFs and unit trusts.

In the example below, the satellite is made up of ETFs and unit trusts that are sector- and industry-specific (e.g. Clean Energy, Artificial Intelligence).

This part of the portfolio can be actively managed and can be adjusted as and when tactical investment opportunities emerge, or as your needs change.

Just like the core, how you decide to construct the satellite portion.

The Barbell Strategy as part of Core-Satellite Portfolio

Advocated by DBS Chief Investment Office (CIO), the Barbell Strategy aims to achieve a balance between risk and reward by investing in Growth and Income assets at both ends of the risk spectrum.

This strategy helps capture superior returns from long-term, irreversible growth trends on one hand, while generating stable income on the other hand to mitigate short-term market volatility.

How does this strategy fit into a core-satellite approach?

Given the long-term, global and multi-asset focus of the Barbell Strategy, it forms the core of your portfolio.

In sum

A core-satellite approach to constructing an investment portfolio is one of the ways to build a diversified portfolio at relatively low costs compared to individual stock picking.

Investors can get consistent returns from the core of the portfolio while positioning themselves for better-than-average returns with the satellites.

While there is flexibility to choose which investments make up the core and satellite portions of your portfolio, do remember to invest according to your risk profile. That way, you pick investments most suited to your financial objectives.

Ready to start?

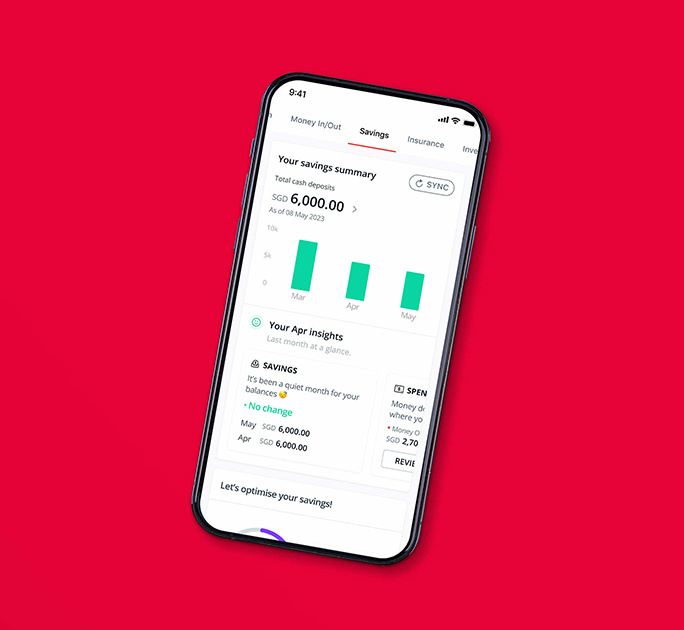

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?